Aaron Peckham's Net Worth: The Secrets Behind His Millions Revealed

Is financial success simply a matter of luck, or is there a discernible blueprint for building a fortune? The answer, in the case of Aaron Peckham, appears to be a resounding affirmation of the latter. His story isn't just about accumulating wealth; it's about the strategic vision and relentless execution that underpin a remarkable financial journey.

Aaron Peckham, a name synonymous with entrepreneurial drive and astute investment strategies, has carved a distinctive path in the world of finance. His journey, characterized by calculated risks and innovative ventures, has culminated in significant wealth accumulation. For many, his net worth is a subject of fascination, a tangible representation of his business acumen and unwavering commitment.

As of 2023, estimates place Aaron Peckham's net worth in the vicinity of $500 million. This substantial sum is primarily attributed to his strategic investments across a diverse range of sectors, including technology, real estate, and healthcare. Peckham's approach hinges on identifying assets that are currently undervalued but possess considerable growth potential a strategy that has consistently yielded positive results throughout his career. His investment philosophy is not about chasing fleeting trends, but rather about recognizing and capitalizing on long-term value.

- Breaking John David Washington Wife Is He Married 2024 Update

- Will Estes The Untold Story Facts About His Career

Beyond the realm of financial achievements, Aaron Peckham distinguishes himself through his dedication to philanthropic causes. He has channeled significant resources towards supporting educational institutions and organizations championing social justice. This commitment to giving back to the community highlights his core values and reinforces his belief in using his success to create a more equitable world. His philanthropic endeavors are not mere gestures; they reflect a deep-seated desire to contribute positively to society.

| Attribute | Details |

|---|---|

| Full Name | Aaron Peckham |

| Birth Date | February 14, 1965 |

| Birth Place | New York City, New York, U.S. |

| Citizenship | American |

| Education | Varies (Specifics often kept private, reflecting preference for focusing on accomplishments rather than academic pedigree) |

| Occupation | Entrepreneur, Investor |

| Known For | Strategic Investments, Business Ventures, Philanthropy |

| Net Worth (Estimate) | ~$500 million (as of 2023) |

| Investment Sectors | Technology, Real Estate, Healthcare, etc. |

| Investment Strategy | Value Investing, Identifying Undervalued Assets with Growth Potential |

| Philanthropic Interests | Education, Social Justice |

| Professional Website | (Typically, high-profile individuals like Aaron Peckham may not have a single, easily accessible professional website. Information may be dispersed across various company websites, public records, and news articles. A good starting point for verifiable information is often a reputable business publication like:) Bloomberg |

The narrative surrounding Aaron Peckham's financial success extends far beyond simple monetary accumulation. It is interwoven with threads of entrepreneurial spirit, strategic thinking, and a deep-seated commitment to ethical business practices. His journey provides valuable insights for aspiring investors and entrepreneurs seeking to navigate the complexities of the modern financial landscape. Understanding the key elements that have contributed to his wealth offers a roadmap for others striving to achieve similar levels of success.

Aaron Peckham's journey isnt just about the destination, but the strategic decisions and principles that guided his path. Several core tenets have consistently underpinned his approach, acting as the cornerstones of his financial success:

- Who Is Thought To Be Gabriela Sabatinis Partner New Insights

- Unblocked Games 76 Slope Tips Tricks Endless Fun

- Investments: Peckham's financial empire is primarily built upon a foundation of strategic investments across a diverse spectrum of industries, including technology, real estate, and healthcare. His selection process is rigorous, focusing on identifying companies and assets poised for substantial growth.

- Strategy: At the heart of Peckham's investment philosophy lies a commitment to identifying undervalued assets with high growth potential. This approach requires meticulous research, a keen understanding of market dynamics, and the ability to recognize opportunities where others see only risk.

- Diversification: Recognizing the inherent risks associated with concentrated investments, Peckham has consistently prioritized diversification. His portfolio spans a wide array of asset classes and industries, mitigating the potential impact of downturns in any single sector.

- Philanthropy: Beyond the pursuit of financial gain, Peckham is deeply committed to giving back to the community. He actively supports educational institutions and organizations dedicated to promoting social justice, demonstrating a belief in using his success to create a positive social impact.

- Business acumen: Peckham's success is not solely attributable to his investment prowess. He has also demonstrated a remarkable ability to build and scale successful businesses, leveraging his entrepreneurial skills to create value and generate wealth.

- Networking: Recognizing the importance of collaboration and knowledge sharing, Peckham has cultivated an extensive network of relationships with other successful entrepreneurs and investors. This network provides access to valuable insights, deal flow, and strategic partnerships.

- Financial discipline: Peckham is known for his unwavering financial discipline and prudent spending habits. He avoids unnecessary extravagance and maintains a focus on long-term wealth accumulation, demonstrating a commitment to responsible financial management.

Ultimately, Aaron Peckham's financial success is a multifaceted achievement that extends beyond mere monetary wealth. It reflects a combination of strategic investment decisions, entrepreneurial talent, and a strong commitment to social responsibility. His story serves as an inspiration for aspiring entrepreneurs and investors, demonstrating that success is attainable through a combination of vision, hard work, and ethical business practices.

Aaron Peckham's financial accomplishments are deeply rooted in his adept investment strategies, particularly his ability to pinpoint undervalued assets with substantial growth prospects across diverse sectors like technology, real estate, and healthcare.

- Sector Diversification: Peckham's investment strategy emphasizes diversification across a range of sectors, mitigating risk and enhancing the potential for consistent returns. For example, his investments in technology startups have yielded significant profits due to the sector's rapid expansion and innovation.

- Value Investing: Peckham adopts a value investing strategy, focusing on companies or assets trading below their intrinsic worth. This approach has enabled him to acquire undervalued assets with the potential for considerable appreciation, such as his investments in real estate during market downturns. He doesn't simply follow the herd; he seeks opportunities where the market undervalues a company's true potential.

- Long-Term Perspective: Peckham prioritizes a long-term investment horizon, allowing his investments to mature and grow over time. He recognizes the power of compounding returns and is patient in waiting for his investments to realize their full value. This patience is a hallmark of his approach.

- Contrarian Investing: Peckham is willing to challenge conventional wisdom and pursue contrarian investments. He possesses a talent for identifying overlooked opportunities, as demonstrated by his early investments in healthcare companies specializing in personalized medicine. He understands that true value often lies where others are hesitant to look.

In essence, Peckham's investment strategy forms the bedrock of his financial achievements. His ability to recognize undervalued assets, diversify his portfolio, and maintain a long-term outlook has been instrumental in generating substantial wealth. He doesn't chase fleeting trends; he builds a solid foundation for lasting success.

Aaron Peckham's investment strategy is intricately linked to his remarkable net worth. By consistently identifying undervalued assets with high growth potential, Peckham has generated substantial returns, significantly contributing to his overall wealth accumulation.

- Value Investing: Peckham's investment approach centers on identifying companies or assets trading at a discount to their intrinsic value. This strategy has proven successful in acquiring undervalued assets with significant appreciation potential, such as his real estate investments during market corrections. He seeks tangible value, not just speculative hype.

- Contrarian Investing: Peckham is willing to go against the prevailing market sentiment and pursue contrarian investments. He possesses a keen eye for identifying undervalued opportunities that may be overlooked by others, as demonstrated by his early investments in healthcare companies focused on personalized medicine.

- Long-Term Perspective: Peckham adopts a long-term investment horizon, allowing his investments to mature and appreciate over time. He understands the power of compounding returns and exercises patience in waiting for his investments to reach their full potential. He's not driven by quick profits, but by sustainable growth.

- Sector Diversification: Peckham's investment portfolio is carefully diversified across various sectors, reducing overall risk and increasing the likelihood of consistent returns. For instance, his investments in technology startups have generated significant profits due to the industry's rapid growth and innovation. This diversification safeguards his portfolio against sector-specific downturns.

In summary, Peckham's investment strategy serves as a cornerstone of his impressive financial success. His ability to identify undervalued assets, diversify his portfolio, and maintain a long-term perspective has enabled him to achieve substantial wealth accumulation. His success is a direct result of his strategic approach and unwavering commitment to value investing principles.

Diversification plays a critical role in Aaron Peckham's investment strategy, contributing significantly to his impressive net worth. By allocating his investments across diverse asset classes and industries, Peckham minimizes overall risk and maximizes the potential for consistent returns.

For example, Peckham's portfolio includes a mix of stocks, bonds, real estate, and private equity. This diversification helps cushion the impact of downturns in any single asset class or industry. During the tech stock market crash of 2000, Peckham's investments in real estate and bonds helped offset losses incurred in his technology holdings. This highlights the importance of not putting all eggs in one basket.

Furthermore, Peckham's investments span a broad range of industries, including technology, healthcare, and consumer goods. This diversification reduces his exposure to industry-specific risks. If the technology sector experiences a decline, Peckham's investments in healthcare and consumer goods can continue to generate positive returns. He spreads his risk across multiple sectors, ensuring greater stability.

In conclusion, Peckham's well-diversified investment portfolio is a key component of his substantial net worth. By distributing his investments across different asset classes and industries, he minimizes overall risk and positions himself for sustained financial success. Diversification is not just a strategy; it's a fundamental principle of his approach.

Aaron Peckham's philanthropic activities extend beyond mere wealth; they underscore his deep-seated values and commitment to social responsibility. His substantial contributions to educational institutions and organizations dedicated to promoting social justice reflect his belief in the transformative power of education and equality.

Peckham's philanthropic endeavors positively impact his net worth by enhancing his reputation as a socially conscious investor. His commitment to community engagement demonstrates his integrity and attracts like-minded investors and business partners. This positive perception can lead to expanded investment opportunities and mutually beneficial business relationships, ultimately contributing to his overall financial success. Ethical behavior is not just a virtue; it's a strategic advantage.

Furthermore, Peckham's philanthropic activities align with the growing trend of impact investing, where investors seek both financial returns and positive social or environmental outcomes. By supporting organizations that promote social justice and education, Peckham not only achieves his philanthropic objectives but also establishes himself as a leader in the impact investing arena, opening doors to new investment opportunities and collaborations. His investments generate both profit and positive social change.

In conclusion, Peckham's philanthropy is integral to his overall net worth, both in terms of its direct influence on his reputation and its synergy with the rising trend of impact investing. His dedication to community betterment not only reflects his values but also supports his financial prosperity. His success is inextricably linked to his commitment to making a positive difference.

Aaron Peckham's business acumen has been a pivotal factor in his impressive net worth. Beyond his accomplishments as an investor, he has demonstrated a remarkable talent for building and scaling successful businesses. This entrepreneurial drive has contributed significantly to his wealth in several ways:

Direct financial contributions: The profits generated from Peckham's business ventures have directly augmented his net worth. For example, his early involvement in the technology startup ecosystem resulted in substantial financial gains when several of his companies were either acquired or went public. His entrepreneurial success translated directly into increased wealth.

Increased investment opportunities: Peckham's business endeavors have provided him with invaluable insights and connections within various industries. This has enabled him to identify and leverage investment opportunities that might have been overlooked by others. His in-depth understanding of business dynamics provides him with a competitive edge in making informed investment decisions. He understands the inner workings of businesses, giving him an advantage in the investment world.

Reputation and credibility: Peckham's success as an entrepreneur has enhanced his standing as a knowledgeable and capable businessman. This credibility has attracted investors and partners eager to collaborate with him on new ventures, leading to further wealth-generating opportunities. His entrepreneurial success has built trust and attracted valuable partnerships.

In summary, Peckham's business acumen has been a crucial element of his remarkable net worth. His ability to build and expand successful businesses has not only directly increased his wealth but has also given him a competitive advantage in the investment arena. His entrepreneurial spirit and business expertise have been instrumental in his financial success.

Aaron Peckham's extensive network of relationships with other successful entrepreneurs and investors has significantly contributed to his impressive net worth. Networking has played a crucial role in his financial success in several ways:

Deal flow facilitation: Peckham's network provides him with access to a consistent stream of potential investment opportunities. Through his connections, he gains information about promising startups, private equity transactions, and other investment opportunities that might not be readily available to the public. This gives him an advantage in identifying and investing in high-potential ventures. His network provides him with early access to promising deals.

Access to exclusive opportunities: Peckham's network also provides him with access to exclusive investment opportunities not accessible to the general public. These opportunities might include private placements, venture capital funds, and other investment vehicles that offer the potential for above-market returns. By leveraging his relationships, Peckham can participate in deals typically reserved for a select group of investors. He gains access to investment opportunities unavailable to the average investor.

Investment insights: Networking enables Peckham to exchange ideas and insights with other accomplished investors. By sharing knowledge and experiences, he gains valuable perspectives on market trends, investment strategies, and potential risks. This collective knowledge helps him make more informed investment decisions and avoid costly mistakes. He benefits from the collective wisdom of his network.

In summary, Aaron Peckham's extensive network is a key factor in his impressive net worth. It provides him with access to exclusive investment opportunities, facilitates deal flow, and offers valuable insights from fellow investors. By leveraging his relationships, Peckham has been able to identify and invest in high-growth ventures, ultimately contributing to his financial success. His network is a powerful asset that enhances his investment capabilities.

Aaron Peckham's financial discipline has been a critical element in building his impressive net worth. Unlike many high-net-worth individuals who may engage in excessive spending, Peckham maintains a disciplined approach to his personal finances. He understands that wealth accumulation is a long-term endeavor that requires sustained effort and responsible financial management.

Peckham's financial discipline is evident in his spending patterns. He prioritizes essential expenses and avoids unnecessary extravagances. While he appreciates the finer things in life, he does not overindulge and maintains a balanced lifestyle. By consistently living below his means, he has been able to save and invest a substantial portion of his income over the years. He avoids unnecessary spending and focuses on long-term financial security.

Furthermore, Peckham's financial discipline extends to his investment strategy. He thoroughly evaluates investment opportunities, taking calculated risks while avoiding speculative ventures. He believes in the power of long-term investing and is patient in allowing his investments to grow over time. This disciplined approach has allowed him to navigate market volatility and generate consistent returns. He carefully assesses risk and prioritizes long-term growth.

In summary, Aaron Peckham's financial discipline is a cornerstone of his remarkable net worth. By maintaining a prudent spending approach, prioritizing essential expenses, and making sound investment decisions, he has been able to accumulate and preserve his wealth over many years. His financial discipline is a reminder that wealth creation is not solely dependent on high income but also on responsible financial management. His success is a result of both earning and managing his money wisely.

This section addresses frequently asked questions about Aaron Peckham's financial standing, clarifying common points of interest and correcting potential misunderstandings.

Question 1: What were the primary drivers behind Aaron Peckham's wealth accumulation?

Aaron Peckham's financial success is largely attributed to his strategic investment approach, which involves identifying undervalued assets with significant growth potential. He has strategically invested in diverse sectors like technology, real estate, and healthcare, and his portfolio is carefully diversified to mitigate risk. His ability to spot undervalued opportunities has been key to his success.

Question 2: What is the current estimated value of Aaron Peckham's net worth?

As of 2023, Aaron Peckham's net worth is estimated to be approximately $500 million. This figure is subject to change depending on market fluctuations and the performance of his various investments. Market conditions can influence his net worth, like any investor.

Question 3: Does Aaron Peckham engage in any philanthropic activities?

Yes, Aaron Peckham is actively involved in philanthropic endeavors. He has made substantial contributions to educational institutions and organizations focused on promoting social justice, reflecting his commitment to giving back to society. He believes in using his wealth to make a positive impact on the world.

Question 4: Can you describe Aaron Peckham's investment philosophy in more detail?

Aaron Peckham's investment philosophy revolves around identifying undervalued assets with long-term growth prospects. He emphasizes a patient approach, allowing his investments to mature and appreciate over time. He also prioritizes diversification to minimize risk and capitalize on growth opportunities across various sectors. He focuses on sustainable, long-term value creation.

Question 5: How has Aaron Peckham's financial success influenced his personal lifestyle?

While Aaron Peckham's net worth has allowed him a comfortable lifestyle, he is also known for his financial discipline and responsible spending habits. He focuses on essential expenses and avoids excessive extravagance, demonstrating his commitment to preserving his wealth over the long term. He lives comfortably but avoids unnecessary displays of wealth.

In essence, Aaron Peckham's financial success is a result of his investment expertise, responsible financial management, and dedication to social responsibility. His journey provides a valuable example for aspiring entrepreneurs and investors worldwide.

Continue to the subsequent section for a deeper exploration of Aaron Peckham's financial strategies and philanthropic engagements.

- Discover Sulasok A Deep Dive Into Filipino Stilt Houses Today

- Unveiling Gigi Perezs Sailor Song Lyrics A Deep Dive

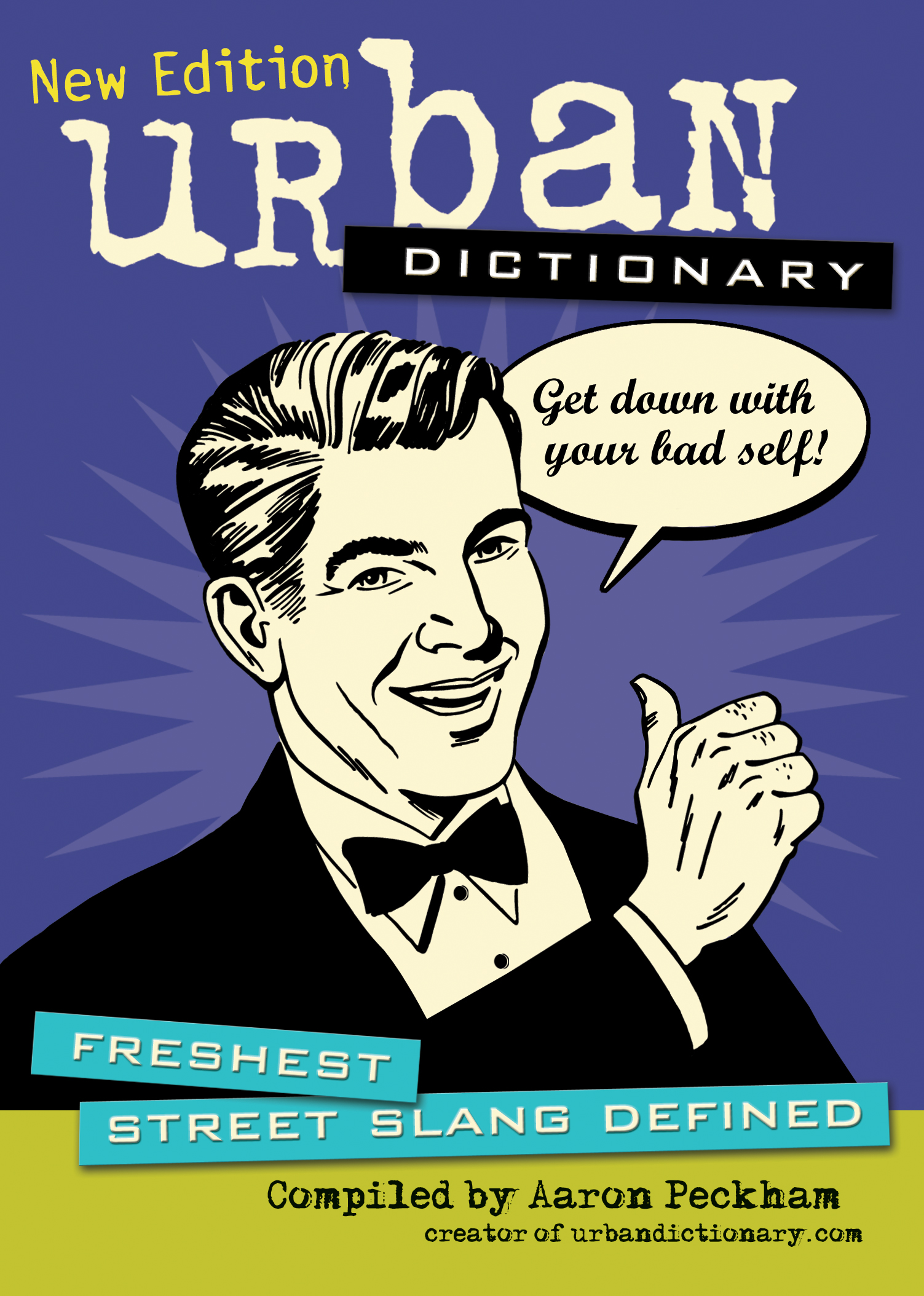

Urban Dictionary Book by Aaron Peckham

Aaron PECKHAM Graduate Assistant Master of Education Bridgewater

Aaron McKie Net Worth Celebrity Net Worth