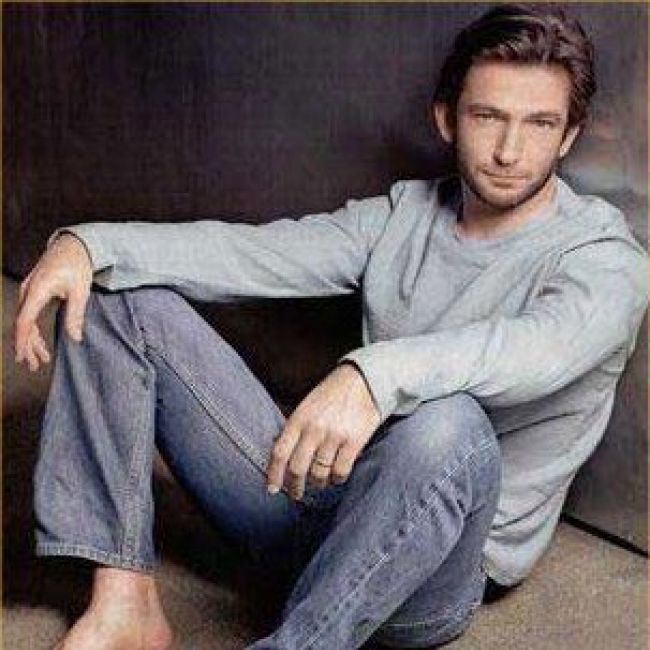

Unveiling: Dan Futterman Net Worth - Estimates & Analysis Explored

Ever wondered how much a prominent figure is really worth? The financial evaluation of individuals, particularly those in the public sphere like Dan Futterman, invariably becomes a topic of widespread interest, often sparking diverse interpretations and carefully calculated estimations.

Net worth, the standard measure of an individual's economic health, is calculated by subtracting total liabilities from the total value of assets. This involves assessing a range of factors, from investment portfolios and real estate holdings to outstanding debts. Obtaining a definitive figure for Mr. Futterman's net worth proves challenging, as such data isn't typically released publicly or readily available from verifiable sources. Any figures circulating are generally estimates that vary depending on the methodology and the origin of the data.

| Category | Details |

|---|---|

| Name | Dan Futterman |

| Occupation | Actor, Screenwriter, Producer |

| Public Profile | Known for his acting roles in films like "The Birdcage" and "Capote," and for writing and producing the acclaimed series "In Treatment" and "The Looming Tower." He has also made notable appearances in television shows and is a respected figure in the entertainment industry. |

| Known for | Academy Award nomination for Best Adapted Screenplay for "Capote," Primetime Emmy Award for Outstanding Writing for a Drama Series for "In Treatment." |

| Reference | Dan Futterman on IMDb |

Gaining insight into an individual's financial standing provides a broader perspective on their economic influence and the potential impact they might have on market trends. However, it's important to approach these figures with a clear understanding of the limitations of estimation, acknowledging the intricate nature of individual financial circumstances. Financial details for someone like Dan Futterman aren't consistently tracked, documented, or publicly reported, contributing to the speculative nature of any net worth assessments.

- Unblocked 76 Your Gateway To Unblocked 76 Gaming Fun Awaits

- Is House Md Really Coming Back Hugh Laurie Speaks Out

The evaluation of Dan Futterman's net worth necessitates a detailed examination of the variables that shape an individual's financial profile. Financial scrutiny of public figures is common, but it is crucial to realize that any resulting figures are frequently rooted in estimations, not concrete data. The world of celebrity finances is often shrouded in speculation, with real numbers remaining elusive.

- Financial data

- Public information

- Estimation methods

- Asset valuation

- Liability assessment

- Privacy considerations

Having access to accurate financial data is paramount when seeking to understand an individual's economic position. However, when dealing with individuals in the public eye, the available data is often incomplete and subject to various estimation techniques. Assessing asset values (such as real estate and investments) and liabilities (debts) is essential for calculating net worth accurately. Moreover, privacy becomes a significant factor, as increased public interest can obscure an individual's true financial situation. The availability of reliable public information is critical for generating accurate estimates of someone like Dan Futterman's net worth. When financial filings or statements are available, they provide insight; when absent, reliance on estimation becomes necessary.

Financial data serves as the cornerstone when trying to understand an individual's net worth. Detailed information concerning both assets and liabilities is essential. For a public figure such as Dan Futterman, obtaining reliable financial data is crucial for a comprehensive evaluation of his economic standing. When this data is accessible and verifiable, it reveals the value of his holdings, investments, and any outstanding debts. Estimates of net worth become inherently uncertain and potentially inaccurate without access to this financial data. The absence of publicly available financial records necessitates that assessments rely on estimations, which are always subject to limitations and might not fully reflect the complexities of an individual's financial circumstances.

- Understanding Misav Exploring The Depths Of Grief And Healing

- Anna Ralphs The Comedic Genius Amp Her Inspiring Journey

The practical importance of accurate financial data cannot be overstated. It presents a clear picture of an individual's overall financial health, which is fundamental for making informed analyses and decisions. For example, examining investment portfolios and property holdings provides insight into investment strategies and potential for future growth. Likewise, knowledge of debt obligations is necessary to evaluate financial stability and potential risks. However, the absence of transparent and verifiable financial information can significantly impede efforts to evaluate someone's economic position. The lack of clear, auditable financial information also introduces bias and uncertainty into any calculation of net worth.

In essence, financial data is the bedrock of accurately assessing net worth. Having access to reliable financial data offers a clear, verifiable, and insightful view of an individual's economic position. The absence of such data, however, introduces uncertainty and necessitates careful interpretation of any estimates. Understanding the role of financial data when assessing net worth is vital for both individual and broader economic analyses, particularly when dealing with complex or obscure situations. The ability to draw definitive conclusions often hinges on the quality and completeness of the financial information available.

Public information plays a pivotal role in estimating an individual's net worth. The type and amount of information that is available directly influences the precision and reliability of these estimations. With someone like Dan Futterman, access to publicly available data, including financial statements, becomes essential for creating a well-informed view of their financial situation. The availability of reliable sources is key to differentiating between informed estimates and mere speculation.

- Financial Filings and Statements

Publicly filed financial documents, when they exist, offer direct insights into an individual's financial standing. These documents often detail assets, liabilities, and income, allowing for a more precise assessment of net worth. However, not all individuals are subject to the same requirements for public disclosure, and the accessibility of these filings often depends on factors such as the individual's profession, business structure, and legal regulations. Therefore, the presence or absence of these documents significantly affects the reliability of any net worth estimate.

- Media Reports and Articles

News articles, magazine profiles, and other media coverage may provide details regarding assets or financial situations. However, these sources often rely on interpretations, estimations, and indirect data. Moreover, the objectivity and accuracy of these reports vary widely, making it difficult to independently verify the information. Consequently, relying solely on media reports to estimate net worth carries the risk of inaccuracies and misinterpretations. Media accounts can offer clues, but they should not be the sole basis of any financial judgment.

- Social Media and Public Statements

Social media posts and public statements can sometimes offer insights into an individual's financial matters. However, these sources are frequently incomplete, highly subjective, and may include potential distortions or misrepresentations. As such, they are not regarded as dependable sources for precise financial assessments. Information shared on these platforms can provide context, but should be treated with caution.

- Industry and Professional Recognition

An individual's industry, profession, and level of accomplishment can suggest a possible range of financial standing. For instance, high-ranking executives in certain sectors often have a greater potential net worth. However, such evaluations are very broad and require more specific evidence before any specific estimation can be supported. Career achievements can provide a general guideline, but they are insufficient on their own.

In conclusion, both the availability and the nature of public information significantly impact estimations of Dan Futterman's net worth. Reliable financial filings provide the most trustworthy and direct evidence. On the other hand, media reports, social media, and industry context should be used carefully, as they often only provide indirect or incomplete information. Any complete evaluation should carefully consider the reliability of the available data while acknowledging the limitations and potential biases that are inherent in each source. Without enough reliable public information, estimations of net worth remain largely speculative.

Estimating an individual's net worth, especially in the case of someone like Dan Futterman, often requires the use of estimation methods, which arise from a lack of easily available, verified data. These methods offer a framework for understanding someone's financial standing, but they are inherently limited. The accuracy of any estimation is tied directly to the method used and the quality of the information that is available. Differing methods of estimation can produce various results, emphasizing the need to carefully consider the approach that is used when interpreting the results.

Various approaches can be employed when estimating net worth. One common method involves analyzing information that is publicly available, such as media reports, industry publications, and social media. However, because these sources often depend on reported figures, speculation, and interpretations, they are prone to inaccuracies. Another method involves using financial data that is publicly available, such as tax filings; however, these often do not present a complete picture and require a thorough understanding of financial reporting standards. Financial analysts and specialists might also use financial modeling techniques to derive estimates, but this method requires specific inputs and assumptions, which can introduce further limitations. Because the selection of any method has a significant impact on the accuracy and validity of the resulting estimate, a meticulous evaluation and consideration of the method used is crucial for interpreting the results. For example, an estimate that is based solely on media speculation will differ significantly from one that uses verified financial records.

In the case of Dan Futterman's net worth, the absence of definitive and readily available financial data emphasizes the role of estimation methods. Because access to personal financial statements and tax returns is limited, analysts are forced to rely on various techniques to form an approximate understanding. This emphasizes the importance of understanding the underlying limitations of these methods. Any complete evaluation should carefully scrutinize the methodology used, considering the reliability of the data, the assumptions that are made, and potential sources of bias, recognizing the inherent uncertainty in these calculations. The primary takeaway is that estimates should be viewed as approximations, not definitive figures, and their limitations should be considered carefully. A thorough understanding of the nuances of estimation methods is essential for gaining a balanced perspective on financial assessments, especially when dealing with private individuals where there is limited data available.

Asset valuation plays an essential role in the process of determining net worth, especially when it comes to individuals like Dan Futterman. Accurate asset valuation is the bedrock for precise net worth calculation. All assets must be evaluated in order to get a complete understanding of an individual's overall financial position. These assets include both tangible items, such as real estate, vehicles, and collectibles, and intangible assets, such as intellectual property and stock holdings. The value of these assets is subject to significant fluctuations, depending on a variety of factors. Market conditions, economic trends, and even personal circumstances have the potential to significantly impact the final valuation. Therefore, accurate data and precise valuation methods are essential to having a reliable net worth calculation. Without these reliable valuation methods, it is impossible to create an accurate estimation of an individual's net worth.

For example, the market value of a property is subject to changes that are caused by location, condition, and demand. Similarly, the value of stocks held by an individual depends on market performance and the overall financial health of the companies that issued the stock. Proper valuation procedures, such as appraisals for real estate and discounted cash flow analysis for businesses, become indispensable. These procedures seek to determine the fair market value, which often differs from the book value or the owner's perceived value. The process of asset valuation requires expertise in the relevant fields, taking into account market fluctuations and economic forces. Accurate asset valuation is essential to understanding Dan Futterman's overall economic position; however, because there is a lack of access to detailed financial records, these valuations remain estimates. This emphasizes the practical implications that accurate valuation has on financial analysis.

In conclusion, asset valuation is inextricably linked to the accurate assessment of net worth, regardless of the individual's public profile. Accurate valuation requires both expertise and meticulous procedures. The value of both tangible and intangible assets plays a significant role in the calculation of net worth. In order to produce a credible and dependable estimate, it is necessary to use precise and accurate valuation methods and supporting data. Financial assessments become inaccurate and potentially misleading without a sound valuation process, which makes it difficult to make informed interpretations and judgments, particularly when there is a lack of readily available financial documentation.

Liability assessment forms an integral piece of the puzzle when determining an individual's net worth. Accurately evaluating liabilities, or financial obligations, is critical for obtaining a precise and thorough understanding of an individual's financial position. In the case of Dan Futterman, and for any individual, liabilities serve to counterbalance assets in order to produce a net worth figure. Without a thorough assessment of liabilities, any net worth calculation is inherently incomplete and potentially misleading.

Liabilities include a wide array of financial obligations, including loans, debts, and outstanding payments. Understanding both the nature and extent of these obligations is vital for creating a complete picture of financial health. For example, significant outstanding mortgage debt has the potential to significantly reduce an individual's net worth. Similarly, significant amounts of credit card debt, unpaid taxes, or legal judgments significantly diminish the value of assets. If these obligations are not accounted for, the picture of financial well-being becomes distorted, obscuring what would otherwise be an accurate depiction of actual financial standing. Therefore, any comprehensive liability assessment is more than just a technical calculation; it is also a critical step in obtaining a full understanding of an individual's financial reality.

The practical significance of thorough liability assessment extends well beyond the specific financial calculation. An accurate understanding of liabilities empowers individuals to make better-informed decisions regarding their financial planning, risk assessment, and potential investment strategies. For instance, the ability to recognize and manage high-interest debt enables individuals to develop effective plans to reduce financial strain and make repayments. Conversely, neglecting liability assessment can lead to financial instability, fewer investment opportunities, and potential legal ramifications. Therefore, by accurately estimating liabilities, individuals can better manage their financial health and safeguard their future financial stability. For someone such as Dan Futterman, a detailed understanding of liabilities becomes particularly important, due to the public interest associated with any significant financial standing.

Privacy considerations have a significant impact on estimations of net worth, especially when it comes to individuals, such as Dan Futterman, who attract attention because of their public profile and receive intense scrutiny regarding their financial standing. The desire to maintain privacy in financial matters often conflicts with the public's desire to understand an individual's economic position. This conflict emphasizes the need for caution and responsible reporting when it comes to this kind of information.

The lack of publicly available financial statements and transparent disclosures has a direct impact on estimations. Because there is no direct access to financial records, analysts must rely on sources that are less precise, which has the potential to lead to assessments that are either inaccurate or skewed. When limited information is available, or when information is presented in a selective manner, the public's perception of an individual's financial status may become distorted. Moreover, estimations often fall short of creating a complete and accurate picture of an individual's true economic condition, perhaps reflecting only part of their financial reality.

The importance of maintaining privacy in financial matters is rooted in the principle of individual autonomy. Personal financial information constitutes sensitive data, and disseminating this data in an unauthorized or indiscriminate manner can have far-reaching consequences. Taking privacy safeguards into consideration is essential for preventing potential harm to both the individual and their family. Without proper respect for privacy boundaries, it is difficult to perform a careful and responsible evaluation of an individual's economic standing. Public scrutiny, particularly when coupled with information that is potentially inaccurate, can exert pressure or cause damage to an individual's reputation or overall well-being. This is particularly concerning when discussing someone like Dan Futterman, whose public standing requires a cautious approach to the way that financial information is interpreted and presented.

By understanding the connection between privacy and estimations of net worth, we can foster a more ethical and responsible approach to reporting on the financial situations of individuals. Accurate estimations depend on access to data that is verifiable and complete; however, because privacy must be respected, direct access to this data is often limited. Therefore, a responsible reporting approach should seek to strike a balance between the public's interest in maintaining financial transparency and an individual's right to privacy. Striking this balance is crucial for maintaining public trust and protecting the privacy rights of individuals during any financial assessment. It is also important to recognize that an individual's financial standing is only one aspect of their life, and that judgments should not be based exclusively on financial data, but rather on a more nuanced and holistic view.

This section will address some common questions that arise regarding Dan Futterman's net worth. All information is based on publicly available data and established estimation methods. We have sought to prioritize accuracy and precision, while recognizing the limitations that come with estimating the financial circumstances of private individuals.

Question 1: Is there an exact figure that can be used to describe Dan Futterman's net worth?

Unfortunately, there is no exact figure that is readily available to describe Dan Futterman's net worth. There is only limited access to financial documents for private individuals that are available to the public. Because of this, estimates of net worth should be approached with caution, and the inherent uncertainty that comes with making these types of estimations should be recognized.

Question 2: How are estimations of net worth calculated?

Estimating net worth requires analyzing a number of factors, including assets (personal property, real estate, and investments) and liabilities (loans and debts). Estimation methods often use publicly available information, professional analyses, and informed estimations. The reliability and comprehensiveness of the data used determines how accurate these estimates are.

Question 3: Why is there not a lot of precise data publicly available regarding Dan Futterman's net worth?

Financial information is often kept confidential. Individuals tend to maintain control over their personal financial data and have strong protections when it comes to keeping that data private. Because public disclosure of this information is not universal, exact figures are often unavailable.

Question 4: What is the value of estimating net worth?

Even in the absence of precise figures, estimating net worth has value in that it can offer some insight into both an individual's financial position and the broader economic context. However, because these estimates are approximations, not definitive figures, they should be interpreted with caution.

Question 5: What is the best way to approach information regarding estimations of net worth so that the appropriate level of caution is used?

The best way to approach estimations of net worth is to recognize the limitations of the data. Because it is complex and involves many uncertainties, estimating net worth also comes with its fair share of difficulties. It is important to distinguish between concrete financial figures and mere estimations. Avoid making definitive conclusions that are based solely on estimations; rather, view the figures as one piece of the puzzle that fits into a broader context.

In summary, it is essential to carefully consider all of the various factors when estimating an individual's net worth, especially when there is no access to comprehensive financial records. Publicly accessible information, when combined with estimations, offers a limited view, but precise figures should be approached with caution, given the inherent uncertainties involved. This FAQ does not cover information pertaining to an individual's financial details, investments, or any legal implications related to financial disclosures.

This marks the end of the FAQ section. The next part of this article will explore broader aspects of financial valuation and will hopefully provide further insight.

In order to accurately assess Dan Futterman's net worth, it is necessary to have a thorough understanding of the information that is available and the limitations that are inherent in making estimations. Because there is no definitive financial data that is readily accessible, analysts must rely on various methodologies, including financial modeling and the analysis of public information. However, because these methods can only produce approximations, the figures are not precise. Several key considerations must be made, including the inherent uncertainties in valuing assets, the limitations of the information that is available to the public, and the importance of maintaining privacy in all financial matters. In order to obtain a complete understanding, it is important to recognize that all estimations are approximations, not definitive measures of financial standing.

Even though the exploration of Dan Futterman's net worth is ultimately limited by the public information that is available, it highlights the complexities that are inherent when evaluating financial standing. In order to accurately interpret the data, it is important to have an understanding of both the methods used and the limitations that are imposed by privacy. In conclusion, a cautious approach and an emphasis on responsible reporting is of the utmost importance when interpreting estimations, particularly when it comes to dealing with individuals and their financial affairs.

- Who Is All About Tom Burke Partner Holliday Grainger

- Aretha Wilson Civil Rights Hero Montgomery Bus Icon

Dan Futterman Movies, Bio and Lists on MUBI

Who is Dan Futterman? Net Worth, Partner, Biography

Who is Dan Futterman? Net Worth, Partner, Biography