Decoding Simon Guobadia's Net Worth: Insights & Analysis Unveiled

Ever wondered how the titans of industry amass their fortunes? Estimating an individual's financial standing can be a surprisingly insightful window into their career choices, risk tolerance, and overall success painting a portrait far richer than just a number. Understanding this figure in its totality is unequivocally illuminating.

At its core, a person's net worth serves as a financial scorecard, representing the culmination of their economic decisions and the impact of external forces. Its the calculated difference between what one ownsassets like investments, real estate, and other valuable possessionsand what one owesliabilities encompassing debts, loans, and outstanding financial obligations. Ascertaining this figure isn't as simple as looking at a bank statement; it necessitates a comprehensive evaluation of an individual's financial portfolio, a task often complicated by the fact that publicly accessible data is frequently incomplete and may only offer a fragmented view.

Delving into an individual's financial standing provides more than just a glimpse of their personal wealth; it offers a deeper understanding of their economic impact. This is particularly relevant in the high-stakes world of business, where investment decisions and strategic financial planning are heavily influenced by market trends, prevailing economic indicators, and the financial health of key players. The ability to estimate an individual's financial success can also shed light on the economic realities of various professions, revealing the potential earnings and financial stability associated with specific career paths. It's a valuable exercise, albeit one that requires a critical approach. Data on financial standing should be assessed with a healthy dose of skepticism, recognizing the inherent uncertainties and limitations that accompany any estimation process. The murkiness often stems from the private nature of financial affairs and the constantly shifting landscape of investments and market conditions.

- Zefoycom The Ultimate Guide To Web Hosting More 2024

- Colin Jost Michael Ches Friendship What Makes It Work

| Category | Details |

|---|---|

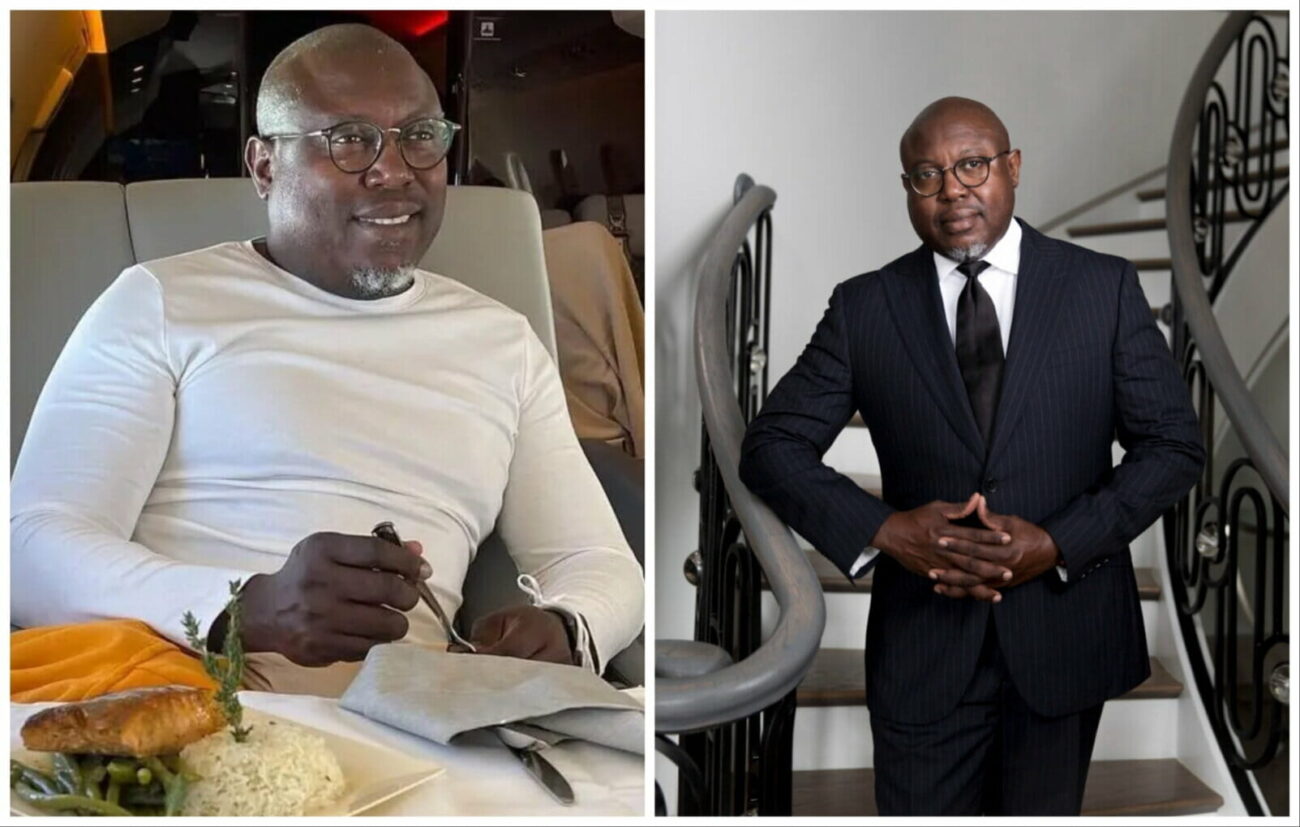

| Name | Simon Guobadia |

| Profession | Entrepreneur, Film Producer, Investor |

| Known for | Executive producer for "Porsha's Family Matters," founder of SIMCOL Petroleum Limited Company, and involvement in various entrepreneurial ventures. |

| Reference | Simon Guobadia's Instagram Profile |

While a definitive, publicly available financial profile for Simon Guobadia remains elusive, probing his career milestones and entrepreneurial activities can reveal telling details about his financial trajectory. Unlocking further insights into this successful entrepreneur necessitates dedicated research, going beyond surface-level observations to uncover the intricacies of his financial endeavors.

Assessing Simon Guobadia's financial standing isn't a simple calculation; it's an intricate exploration of the multifaceted forces that shape an individual's wealth. This involves a deep dive into his established career, a close examination of his diverse investments, and a holistic understanding of his overall financial strategy.

- Financial Assets

- Investment Portfolio

- Income Sources

- Business Ventures

- Property Holdings

- Liabilities

The hard figures that would precisely quantify Simon Guobadia's net worth aren't publicly broadcast. Calculating net worth demands the meticulous aggregation of financial holdings, balanced against any outstanding debts or obligations. Analyzing the tapestry of income sources be it from established salaries, strategic investments, or thriving business ventures is an indispensable step. Moreover, scrutinizing property ownership, dissecting the composition of investment portfolios, and diligently documenting any liabilities provide critical data points to inform the overall valuation. The very absence of readily available data underscores the inherent challenges in arriving at a precise estimate of an individual's financial standing. Without the transparency of public disclosures, a detailed assessment remains largely speculative, further emphasizing the often closely guarded nature of substantial wealth information.

Financial assets stand as a cornerstone in the assessment of individual net worth. These assets, representing holdings with measurable monetary value, exert a powerful influence on an individual's overall financial landscape. Gaining a deep understanding of both the nature and composition of these assets is of paramount importance when determining financial standing. In the specific pursuit of estimating Simon Guobadia's net worth, meticulously analyzing his array of financial assets emerges as a critical and unavoidable area of investigation.

- Investments

Investments, the dynamic engine of wealth accumulation, typically span a diverse spectrum, from the predictable stability of bonds to the high-growth potential of stocks, and the collective power of mutual funds, not to mention the tangible solidity of real estate. A thorough evaluation of these investments, encompassing their type, current valuation, and historical performance, provides invaluable insight into an individual's financial health. The very diversification and risk profile inherent in these investments offer essential context. For instance, a portfolio dominated by high-growth stocks may signal a significantly higher net worth compared to one cautiously anchored in low-yield bonds, underscoring the powerful link between strategic investment choices and overall wealth.

- Cash and Cash Equivalents

Cash, the lifeblood of financial flexibility, and its readily accessible cousins, cash equivalents such as savings accounts and money market funds, provide immediate liquidity. These assets serve as powerful stabilizers in an individual's financial structure, contributing substantially to their overall economic health and adaptability. A substantial cash reserve may reflect a financially conservative approach, or it could signify strategic positioning for future investment opportunities. Regardless, the proportion of liquid assets an individual maintains often serves as a telling indicator of their financial well-being.

- Real Estate Holdings

Real estate holdings, encompassing an array of properties from cozy residential homes to sprawling commercial complexes and undeveloped land, often constitute a substantial portion of an individual's asset base. The precise value and strategic location of these holdings become pivotal in determining their overall impact on an individual's net worth. Beyond the inherent characteristics of the properties themselves, external factors such as prevailing property market trends and specific local conditions exert considerable influence on valuation. Consequently, the presence and assessed worth of real estate holdings are undeniably influential in shaping an individual's overall financial standing.

These examples illustrate the inherent complexities that arise when dissecting the different facets of financial assets to determine an accurate net worth. While a fully comprehensive analysis would demand detailed information about specific holdings, these categories nevertheless serve to spotlight the essential aspects that constitute financial assets, providing a valuable framework for generating a well-informed estimate. However, without access to precise data pertaining to Simon Guobadia's assets, any assessment remains necessarily speculative. Therefore, further, more in-depth research is essential to move towards a more refined and accurate evaluation of his true financial standing.

An individual's investment portfolio stands as a pivotal determinant of their overall net worth. The performance and inherent value of the investments within this portfolio exert a direct and significant impact on their overall financial standing. A robust portfolio, strategically crafted and demonstrating consistent positive performance, has the potential to substantially contribute to a high net worth. Conversely, poor investment choices or the unfortunate occurrence of market downturns can rapidly erode net worth, highlighting the inherent risks involved. Ultimately, the soundness of investment strategies, alongside the recognition and skillful navigation of the inherent risks associated with various investment options, become critical factors. For instance, a diversified portfolio that includes a well-balanced mix of stocks, bonds, and alternative assets is generally recognized as offering superior risk management compared to a concentrated portfolio heavily weighted towards a single asset class.

The intricate composition and demonstrable performance of an investment portfolio represent crucial elements in the complex calculation of net worth. Assets within this portfolio, including stocks, bonds, real estate holdings, and a variety of other investment vehicles, are inherently subject to value fluctuations, influenced by dynamic market conditions. These fluctuations exert a direct effect on an individual's total net worth, causing it to rise or fall in response to market forces. History offers countless examples to illustrate this principle; periods of sustained market growth have often precipitated substantial increases in net worth for those strategically invested, while unforeseen market downturns have resulted in significant losses and corresponding reductions in net worth. Understanding the deep connection between investment decisions and overall financial status is, therefore, paramount for both individual investors and institutions alike. The inherent risks interwoven with each investment option must be meticulously weighed against the potential rewards, recognizing that every choice carries a degree of uncertainty. Effective risk management, which encompasses diversification, hedging strategies, and disciplined asset allocation, is undeniably essential for long-term financial stability. Ultimately, the anticipated return on investment (ROI), carefully balanced against the potential for loss or gain, constitutes a fundamental consideration when constructing a prudent and resilient investment strategy.

In summary, an individual's investment portfolio emerges as a critical determinant of their overall net worth. The consistent performance and carefully considered composition of investments directly impact the individual's financial picture, defining both the present situation and future potential. A well-managed and strategically diversified portfolio is a powerful engine for wealth accumulation, substantially contributing to a rising net worth. Conversely, poorly informed investment decisions, compounded by adverse market conditions, can trigger significant losses and reduce net worth. Understanding this inherent connection between well-executed investment strategies and net worth becomes vitally important for making informed financial decisions and securing long-term financial stability. However, it's crucial to acknowledge that further in-depth investigation into specific investment portfolios and their demonstrable impact on net worth requires access to detailed financial data that is often not readily available to the public.

Income sources serve as a direct and undeniable influence on an individual's financial standing, contributing significantly to their overall net worth. Comprehending both the nature and magnitude of these income streams becomes essential when evaluating their overall financial health and the potential for future wealth accumulation. In essence, the meticulous analysis of income streams unlocks a deep understanding of the factors that either propel wealth accumulation or, conversely, contribute to financial stagnation.

- Salaries and Wages

Salaries and wages represent a fundamental and often primary source of income for a vast majority of individuals. The total amount of compensation received directly translates into available funds, providing the resources necessary for strategic investment, necessary expenses, and the accumulation of savings. Both the consistent flow and absolute scale of salary or wages exert a powerful influence on an individual's capacity to build wealth over time. It's a general rule that high-paying jobs situated in specialized fields or rapidly growing industries often correlate with a greater potential for achieving a higher net worth. Moreover, variations in compensation structures, such as the inclusion of performance-based bonuses or comprehensive benefits packages, will also significantly impact overall income.

- Investment Income

The returns generated from strategic investments, encompassing dividends earned on stocks, interest accrued on bonds, or capital gains realized through the sale of appreciated assets, constitute a substantial portion of income for those with sizable investment portfolios. The demonstrable performance of these investments exerts a direct impact on the overall income stream, thereby contributing to either the growth or decline of net worth. The consistency of investment returns over extended periods can exponentially increase overall wealth accumulation. Consequently, the specific types of investments held within a portfolio, and the yields they generate, become critical factors in determining financial success.

- Business Income

For entrepreneurs and business owners, income flows directly from the operational success and overall profitability of their ventures. The scale and sustained success of a business exert a powerful influence on the owner's overall income potential. Profit margins, streamlined operational efficiency, and strong market demand all combine to heavily influence the total amount of income generated. Thriving business ventures can unlock substantial revenue streams, potentially driving a significant increase in net worth. Conversely, a struggling business, burdened by operational challenges or hampered by market conditions, might result in lower income or even negative financial performance.

- Other Income Sources

The landscape of income sources extends beyond traditional avenues, encompassing diverse opportunities such as royalties earned from intellectual property, licensing fees secured through patented technologies, or consistent rental income generated from property holdings. These additional sources can substantially increase overall income, ultimately contributing to an elevated net worth. The very diversification of income streams can mitigate risk, enhancing overall financial security and resilience. Ultimately, both the reliability and predictability of these diversified sources, along with the consistent amount of income they generate, become critical factors to carefully consider. For example, rental income derived from strategically selected property can provide a dependable stream of passive income, supplementing traditional earnings and bolstering financial stability.

Ultimately, the analysis of income sources serves to illuminate the core factors that impact an individual's overall financial position. The dynamic interplay between these various sources, their consistency over time, and their associated potential for growth strongly influence the ability to accumulate wealth and, consequently, shape an individual's overall net worth. However, it's essential to acknowledge that without access to specific and detailed financial data, a comprehensive analysis of income sources for an individual such as Simon Guobadia becomes speculative. Consequently, further rigorous research is required to develop a more complete and reliable understanding of the precise role that income sources have played in shaping his overall financial standing.

Business ventures represent a significant and impactful component in the complex equation that determines net worth. Successful ventures are not just about generating revenue; they are powerful engines that contribute to overall wealth accumulation. The profitability of these ventures, their scale of operation, and their longevity in the marketplace exert a direct and tangible influence on an individual's financial standing. For example, a highly successful and rapidly scalable business possesses the potential to generate substantial profits, leading to a significant and sustained increase in net worth over time. Conversely, business ventures that fail to meet expectations or suffer from underperformance can have a detrimental impact on net worth, eroding accumulated wealth and hindering future growth.

The specific nature of business ventures significantly affects their potential impact on net worth. A venture that is strategically focused on achieving high-profit margins, demonstrating rapid and consistent growth, and implementing efficient operational strategies is far more likely to contribute significantly to overall wealth accumulation than a venture burdened by low profit margins, struggling with slow growth, or hampered by persistent operational inefficiencies. Strategic planning, sound financial management practices, and effective market positioning are crucial for generating significant returns and maximizing the financial benefits derived from business ventures. Successful entrepreneurs are often distinguished by their ability to consistently reinvest profits back into their businesses, manage resources prudently and efficiently, and adapt their strategies in response to the ever-evolving dynamics of the marketplace. Prime examples include individuals who have successfully founded and grown innovative technology companies, established profitable franchises through strategic expansion, or managed investment firms that have consistently delivered high returns to their investors. Ultimately, the demonstrable value of business ventures in the calculation of net worth underscores their undeniable importance in the broader economic landscape. However, without possessing specific and detailed information about Simon Guobadia's business ventures, any assessment of their precise influence on his overall net worth becomes inherently speculative.

In conclusion, business ventures are undeniably key drivers in shaping an individual's overall net worth. Their ultimate success or failure demonstrates a direct correlation with overall financial prosperity, defining the path to wealth accumulation or financial stagnation. Profitability, the potential for rapid and sustainable growth, and the implementation of effective management strategies emerge as critical factors in determining the ultimate contribution of business ventures to an individual's overall net worth. While the profound connection between successful business ventures and a rising net worth is undeniably evident, a more specific and reliable assessment of Simon Guobadia's ventures requires access to financial information that is often closely guarded and not readily available to the public. Therefore, without such data, a precise evaluation of his overall net worth remains unattainable.

Property holdings stand as a significant cornerstone in the comprehensive evaluation of an individual's overall net worth. The inherent value and specific type of real estate assets owned contribute substantially to the total financial picture, influencing not only current financial standing but also future potential. Appreciation in property value over time, the consistent generation of rental income, and the strategic selection of prime locations can all significantly and positively impact an individual's financial standing. Consequently, carefully examining property holdings provides critical insight into the underlying investment strategies and overall financial decisions that influence an individual's accumulated wealth.

- Value Appreciation

Property values, inherently dynamic, are constantly fluctuating based on prevailing market conditions, the desirability of specific locations, and the overall levels of demand. Properties situated in highly desirable areas or regions experiencing rising market trends often demonstrate significant appreciation in value, directly contributing to an increase in an individual's overall net worth. The difference between the original purchase price and the current fair market value of a property effectively represents a quantifiable portion of the owner's accumulated wealth. This appreciation can prove to be particularly substantial over extended periods, especially in markets characterized by high growth and consistent demand.

- Rental Income Potential

Properties possess the unique capacity to generate consistent income through formal rental agreements with tenants. The specific amount of rental income that can be realized depends on a variety of factors, including the overall property size, its strategic location within a given market, prevailing market rent rates, and the consistent occupancy of the property by tenants. Consistent rental income provides a predictable stream of passive income, contributing positively to overall wealth and reducing an individual's reliance on other, potentially less stable, income sources. Effective property management practices, including proactive tenant relations, preventative maintenance, and strategic marketing, can maximize rental income while minimizing associated costs, ultimately increasing the net worth benefit derived from the property.

- Property Types and Locations

The specific type and strategic location of the properties an individual holds within their portfolio exert a significant influence on their overall value and potential return on investment. Luxury properties situated in prime and highly sought-after locations often command premium prices, attracting high-quality tenants and yielding higher rental income streams. The inherent type of property, be it a residential dwelling, a commercial building designed for business use, or undeveloped land with future potential, also determines its overall suitability for specific investment strategies. For example, a diverse property portfolio that encompasses a variety of property types can enhance risk mitigation, while simultaneously diversifying income streams and creating a more resilient investment base. Understanding the specific characteristics of each individual property type, including its suitability for specific markets and its appeal to particular tenant profiles, adds significant and valuable context to the overall assessment of property holdings.

- Long-Term Investment Potential

Property holdings inherently represent a long-term investment strategy, characterized by the potential for sustained growth and the accumulation of wealth over extended periods. The long-term stability of real estate assets, coupled with their potential for significant appreciation in value, are crucial considerations for individuals seeking to build lasting wealth over time. The strategic acquisition of properties in areas characterized by consistent growth and future development may yield considerable long-term returns, solidifying their financial position. Factors such as local zoning regulations, infrastructure development plans, and overarching market trends exert a significant influence on the long-term value and sustainable income potential of these investments, making informed decision-making a critical component of success.

In summary, property holdings play a multifaceted role in the overall evaluation of net worth, shaping both current financial standing and long-term economic prospects. The dynamic interplay of factors such as consistent appreciation in value, the potential for reliable rental income, the specific type of property owned, and the strategic selection of prime locations significantly influences an individual's overall financial status. Understanding the intricacies of property holdings and their various contributing aspects is essential to conducting a comprehensive and well-informed analysis of an individual's overall financial portfolio. While specific details about Simon Guobadia's property holdings are not publicly available, analyzing these core concepts helps to contextualize the broad significance of real estate investments in determining overall net worth.

Liabilities represent a critical and often overlooked component in the assessment of an individual's overall net worth. These liabilities, encompassing a range of financial obligations such as outstanding debts, active loans, and other outstanding financial commitments, exert a direct and significant impact on an individual's overall net worth. When evaluating Simon Guobadia's financial standing, a thorough and nuanced understanding of his existing liabilities is of paramount importance. By subtracting these liabilities from his total assets, a clearer and more accurate picture of his true net worth emerges, providing a more reliable representation of his underlying financial position.

- Outstanding Loans

Outstanding loans, encompassing a variety of financial instruments such as mortgages secured against real estate, personal loans used for various purposes, and business loans used to fuel entrepreneurial ventures, represent significant liabilities that can substantially impact net worth. The principal amount of these loans, the associated interest rates, and the established repayment schedules all directly affect the overall financial burden and the rate at which debt diminishes assets. High levels of outstanding loans have the potential to significantly diminish an individual's net worth, potentially offsetting the value of held assets and creating a challenging financial landscape. Analyzing loan terms and repayment schedules is crucial to accurately determine the current and future financial strain that loans place on an individual, allowing for informed decision-making and strategic financial planning. The type of loan, its size relative to overall assets, and the associated interest rates all contribute to influencing their overall impact on an individual's financial health.

- Credit Card Debt

Credit card debt, often characterized by high-interest rates and fluctuating balances, can significantly contribute to overall liabilities and negatively impact net worth. Accumulated credit card balances, particularly those carrying substantial interest charges, represent a considerable financial obligation that erodes available assets. The total interest accruing on these balances, and the total length of time required to fully repay this debt, directly affect the amount that is ultimately subtracted from an individual's potential net worth. Effective management of credit card balances, including making timely payments and minimizing unnecessary spending, is crucial for maintaining long-term financial stability and protecting against the detrimental effects of compounding interest. Analyzing the overall impact of credit card debt on Simon Guobadia's overall net worth necessitates a thorough consideration of total debt levels, the associated interest rates, and his overall approach to managing credit.

- Taxes Owed

Tax obligations, both at the federal and local level, represent unavoidable financial responsibilities that must be meticulously addressed to maintain financial stability. Unpaid or outstanding tax liabilities, representing a direct financial obligation to governmental entities, can significantly diminish net worth and create considerable financial stress. Prompt and accurate tax reporting, coupled with timely payment of all tax obligations, minimizes this potential impact and ensures compliance with legal requirements. Delays in tax payments, disputes with taxing authorities, or failures to accurately report income can substantially increase liabilities, requiring careful and strategic management to avoid adverse impacts on overall net worth. Ultimately, failure to proactively address tax obligations can significantly reduce overall financial well-being, underscoring the importance of financial prudence and responsible tax planning.

- Other Financial Obligations

Beyond the commonly recognized liabilities such as loans, credit card debt, and taxes owed, a broader spectrum of other financial commitments may exist, encompassing pending legal judgments, unresolved contractual obligations, or other contingent liabilities that may exert a future claim on assets. These often-overlooked obligations, potentially encompassing significant financial amounts, are often not readily apparent without access to detailed and comprehensive financial records. Understanding the presence and inherent nature of these obligations is absolutely crucial to fully assess their potential impact on an individual's overall net worth and to accurately calculate their true financial standing. Accurately identifying and meticulously quantifying these obligations is vitally important to avoid the pitfalls of hidden financial burdens that could significantly reduce net worth figures, creating a distorted and inaccurate financial picture.

Liabilities, therefore, emerge as a crucial and undeniable component in the accurate determination of net worth. A comprehensive and detailed assessment of Simon Guobadia's overall financial situation necessarily requires careful and nuanced consideration of his outstanding loans, his total credit card debt, any outstanding tax liabilities, and any other financial obligations that may exert a claim on his assets. A reduction in liabilities, through strategic debt repayment or proactive financial planning, strengthens an individual's financial position, ultimately leading to a higher and more robust net worth. The significant impact that these liabilities exert on net worth underscores the paramount importance of sound financial management and responsible debt handling, particularly in the context of long-term financial stability and wealth accumulation. Therefore, access to detailed and reliable financial information is absolutely essential to accurately analyze the full impact of liabilities in shaping the overall picture of Simon Guobadia's net worth and financial standing.

This section aims to address the most frequently asked questions regarding Simon Guobadia's financial standing, providing clarity and perspective in a landscape often shrouded in speculation. Accurate estimations of net worth require access to detailed and comprehensive financial data, which is often not publicly available for private individuals. Consequently, this FAQ seeks to provide valuable context, clarify common misconceptions surrounding the topic of net worth, and shed light on the intricacies of financial estimations.

Question 1: What is net worth, and why is it important?

Net worth, at its core, represents the calculated difference between an individual's total assets (the sum of all things they own that hold value) and their total liabilities (the sum of all debts and financial obligations they owe to others). Essentially, it reflects an individual's overall financial position at a specific point in time, offering a snapshot of their economic health and long-term potential. Various factors, including strategic investments in stocks, bonds, and real estate; ownership of valuable property; and consistent income sources from salaries, businesses, or investments, contribute to an individual's total assets. On the other side of the equation, outstanding loans for homes or businesses, accumulated credit card debt, and other financial obligations represent the liabilities that offset those assets.

Question 2: Why is precise data about Simon Guobadia's net worth often unavailable to the public?

Financial details, including specific information about an individual's net worth, are generally considered to be private and confidential. Individuals typically have the right to control access to their personal financial information, limiting its public availability. Consequently, publicly available information about a person's financial standing may be limited to figures reported in specific contexts, such as business filings or real estate transactions, and these figures are rarely comprehensive or entirely up-to-date. Generating reliable and precise estimates of net worth requires access to detailed financial records, including bank statements, investment portfolios, and loan agreements, which are typically not shared publicly and are often protected by privacy laws.

Question 3: How do consistent income sources contribute to an individual's overall net worth?

Consistent and substantial income streams, derived from various sources such as traditional salaries, successful business ventures, or strategic investments, directly contribute to a measurable increase in an individual's overall net worth. The specific types of income and the sustained consistency of those income streams exert a significant influence on the individual's ability to accumulate wealth over time, driving their financial growth and strengthening their long-term economic security. For example, income earned from high-yield investments or consistently profitable business activities often yields varied and potentially greater results, contributing differently to overall net worth than a steady but more limited salary.

Question 4: What specific role do investments play in the complex determination of net worth?

Strategic investments in a diverse range of assets, including stocks, bonds, real estate holdings, and alternative investment vehicles, can substantially contribute to an individual's overall net worth, building wealth and securing their financial future. The demonstrable performance of these investments, measured by factors such as appreciation in value and consistent income generation, directly affects their overall worth and, consequently, the individual's overall net worth. Diverse and well-managed investment portfolios, typically characterized by a strategic allocation of assets and a long-term investment horizon, often lead to a greater accumulation of wealth over time, outpacing more conservative or speculative investment approaches.

Question 5: Can successful business ventures significantly influence an individual's net worth, and if so, how?

Successful and consistently profitable business ventures have the potential to significantly elevate an individual's overall net worth, transforming their financial landscape and creating lasting economic security. Numerous factors, including sustained profitability, robust growth rates, strategic market positioning, and effective operational management, heavily influence the overall contribution of business ventures to an individual's overall financial standing. For example, businesses that demonstrate consistent revenue growth and maintain healthy profit margins often contribute substantially to the owner's overall net worth, building long-term financial security and creating opportunities for further investment. Conversely, unsuccessful ventures, characterized by financial losses or stagnant growth, can significantly reduce net worth, eroding accumulated wealth and hindering future financial progress.

In conclusion, understanding the nuances of net worth requires a comprehensive consideration of assets, liabilities, and the various financial factors that shape an individual's economic standing. Estimating an individual's net worth often requires access to comprehensive and private financial data, making precise figures challenging to obtain for individuals who do not publicly disclose their financial information.

Moving forward, further investigation may reveal more details about Simon Guobadia's financial trajectory, should such details become publicly accessible through filings, interviews, or other sources. Understanding net worth and its contributing factors remains a valuable exercise in analyzing financial health and the principles of wealth accumulation.

Determining Simon Guobadia's net worth is not a simple calculation but rather a complex endeavor that necessitates a comprehensive analysis encompassing various factors, from easily quantifiable assets to more elusive liabilities. This exploration must include evaluating diverse income sources, encompassing salaries, investments, and business profits; assessing the current value of tangible assets such as diverse investments and real estate holdings; and meticulously accounting for all outstanding liabilities, including loans, debts, and other financial obligations. However, in the absence of publicly available financial disclosures, a precise estimation of net worth remains an elusive goal, one that can only be approached through careful research and informed speculation. Key factors that are known to significantly influence an individual's financial standing include the consistent performance of their investment portfolio, the sustained profitability of their business ventures, and the overall assessed value of their real estate holdings. Furthermore, the burden of outstanding debts and other financial obligations exerts a significant effect on the final calculation, reducing the overall net worth figure. Ultimately, the absence of readily accessible financial data underscores the inherent limitations and unavoidable challenges in estimating the private wealth of individuals who choose not to publicly disclose their financial information. A thorough and comprehensive understanding of all of these elements is, therefore, crucial for achieving a complete and nuanced assessment of an individual's financial position, particularly in the context of their overall economic standing and long-term financial prospects.

The continued pursuit of understanding the multifaceted nature of financial standing, as exemplified by the ongoing inquiry into Simon Guobadia's net worth, emphasizes the complex interplay of a wide array of economic factors, each contributing uniquely to the overall financial picture. This pursuit requires the careful consideration of various income streams, the strategic implementation of diverse investment strategies, and the proactive management of debt through responsible financial practices. Ultimately, access to detailed and verifiable financial information is essential for achieving a precise and reliable estimation of an individual's net worth, providing a clear and accurate representation of their economic standing. Further research and in-depth analysis are, therefore, warranted to explore the specific components of Simon Guobadia's individual financial trajectory, should such detailed information become publicly available, shedding light on the factors that have shaped his financial success.

- Cote De Pablos Husband All About Diego Serrano Her Love

- All About Florence Welchs Boyfriend Secrets Revealed

Simon Guobadia net worth, age, first wife, children, career, biography

Simon Guobadia Net Worth 2024 How Rich is the Producer?

Who Is Simon Guobadia Net Worth?