Lisa Hogan Net Worth: What's Her Financial Standing?

Ever wondered how the stars of our favorite shows manage their fortunes? While the lives of celebrities often play out in the public eye, their financial details are usually shrouded in mystery. But understanding the financial standing of individuals like Lisa Hogan provides insights into their success and how they navigate the world of wealth.

Calculating the precise net worth of anyone, Lisa Hogan included, is a complex endeavor. It's a dynamic figure that represents the total value of their assets encompassing investments, property, and other holdings minus their liabilities, such as debts and loans. Pinpointing this figure exactly is challenging because asset values can fluctuate with market conditions, and complete financial transparency is rarely available to the public. A crucial point to remember is that net worth provides a snapshot in time, a financial portrait that can shift dramatically due to various economic factors.

| Category | Details |

|---|---|

| Occupation | Actress, Reality TV Star, Gallery Owner, and Businesswoman |

| Known For | Starring in the Amazon Prime series "Clarkson's Farm," managing a gallery, and her relationship with Jeremy Clarkson. |

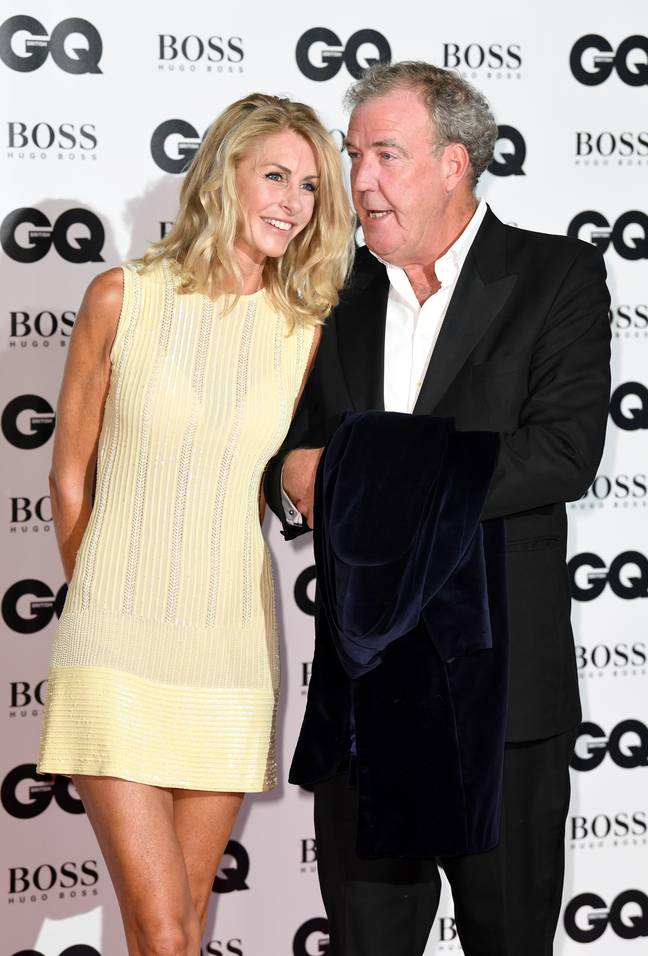

| Public Profile | Lisa Hogan is known for her role in "Clarkson's Farm," where she provides a down-to-earth, practical presence amidst the chaos of Diddly Squat Farm. She has also been seen in various media outlets due to her relationship with Jeremy Clarkson. A former model and sculptor, she also manages a gallery in Ireland. |

| Reference Link | IMDB Profile |

A deeper understanding requires exploring aspects of her career, investment decisions, and any philanthropic endeavors. This level of investigation is crucial in providing a well-rounded view of her financial position, although accessing all the relevant information can be a significant challenge.

- Understanding Misav Exploring The Depths Of Grief And Healing

- Luke Combs Politics Is Luke Combs A Democrat Or 2024 Update

Determining Lisa Hogan's net worth necessitates carefully weighing various contributing factors. It involves evaluating her assets, cataloging liabilities, and assessing her overall financial footing to paint a picture of her economic standing at a specific moment.

- Assets

- Liabilities

- Income

- Investments

- Real Estate

- Expenses

- Public Information

- Valuation Methods

Each element assets, liabilities, income streams, investment portfolio, real estate holdings, pattern of expenses, gleanings from public information, and the valuation methodologies applied plays a distinct role in shaping our understanding of Lisa Hogan's financial standing. A robust income coupled with significant investments in real estate, for example, generally points to a higher net worth. Limited public disclosures can offer a basic framework for estimating a person's financial status. Valuation methods, the tools financial analysts use, are crucial for quantifying assets and determining approximate worth.

Assets are the building blocks of wealth, directly influencing Lisa Hogan's net worth. Defined as items of economic value owned by an individual, assets form a cornerstone of overall net worth calculations. Their value, whether tangible or intangible, significantly contributes to the overall financial assessment. Real estate holdings, stock portfolios, and various investments are all examples of tangible assets that add to the calculation. Even intangible assets, such as intellectual property or a strong professional reputation, hold intrinsic value but can be more difficult to quantify precisely.

- Untold Facts Miranda Harts Partner Relationship More

- Lil Jeff The Untold Story Of Rising Star Rapper 2024 Update

The fundamental relationship between assets and net worth is undeniable. A considerable increase in the value of assets a surge in stock market value or a property boom, for instance generally leads to a corresponding increase in net worth. Conversely, a dip in asset values due to market volatility or other factors can erode that net worth. This principle applies universally, far beyond Lisa Hogan's specific circumstances. The assessed value of assets is a core component in calculating and interpreting a person's overall financial standing.

In summation, assets are central to determining net worth. Their value, whether easily quantifiable or somewhat abstract, exerts considerable influence on an individual's financial position. Fluctuations in asset value directly affect net worth calculations, making a clear understanding of this connection vital for anyone seeking to assess financial situations, both on a personal and macroeconomic scale.

Liabilities represent the financial obligations or debts that Lisa Hogan carries. They directly impact her net worth by diminishing its overall value. The calculation of net worth involves subtracting liabilities from assets to arrive at a final, telling figure. The higher the level of liabilities, be they significant loans or outstanding credit card debts, the lower the overall net worth.

It is supremely important to consider liabilities when assessing a person's net worth. Substantial outstanding mortgages, significant personal loans, or spiraling credit card debts all detract from overall net worth. In contrast, paying down debt or eliminating a loan translates directly into an increase. An individual burdened with substantial debt may have a considerably lower net worth than someone with similar asset holdings but far fewer liabilities.

In conclusion, liabilities are a critical component of net worth calculations. They signify obligations that decrease the overall value. A careful examination of both assets and liabilities is essential for a comprehensive understanding of anyone's financial position. Overlooking liabilities gives an incomplete and potentially misleading portrayal of someone's net worth, potentially obscuring underlying financial vulnerabilities. Recognizing the impact of liabilities on net worth is vital for informed financial decision-making.

Income wields significant influence over Lisa Hogan's net worth. A steady and substantial income serves as the primary engine driving asset accumulation. Earnings provide the fuel for investments, allow for the purchase of assets, and contribute to savings all directly boosting net worth. Conversely, an insufficient or unstable income stream limits the ability to acquire assets and can lead to increased liabilities, thereby eroding net worth.

The connection between income and net worth is undeniable. Imagine Lisa Hogan experiencing a significant increase in income stemming from a successful business venture or a career promotion. This boost in earnings empowers her to invest more strategically, acquire additional assets like real estate or stocks, and aggressively pay down existing debt. The probable outcome is an increase in her overall net worth. Conversely, a decline in income due to job loss or economic downturn might create difficulties in maintaining current asset holdings. She might need to liquidate assets to cover living expenses, and existing debts may become more challenging to manage. The stability and growth of income are foundational to building and maintaining a healthy net worth.

In summary, income is a vital force shaping Lisa Hogan's net worth. It directly funds the acquisition and expansion of assets, thereby improving overall financial standing. Income stability is essential for both maintaining and augmenting net worth. Comprehending this direct correlation is critical for making informed financial decisions and managing personal finances effectively. Difficulties in maintaining or increasing income inevitably impact net worth calculations. This principle is universal, applying across varied financial situations.

Investments exert a powerful influence on Lisa Hogan's net worth. Investment strategies, both successful and unsuccessful, have a direct impact on the overall financial picture. Astute investments translate into increased asset holdings, thereby boosting net worth. Poorly timed or poorly executed investments can result in losses, diminishing the value of her portfolio and, consequently, her net worth. The extent of this impact is dependent on the scale and nature of the investments.

Consider the range of investments Lisa Hogan might have stocks, bonds, real estate, or other business ventures. The value of these investments fluctuates in response to market conditions. Favorable market trends tend to enhance investment values, contributing to a higher net worth. Unfavorable trends can result in decreased asset value, thus impacting net worth. A diversified investment portfolio is crucial to mitigating risk, potentially smoothing out the effects of market swings on overall net worth. Success stories and cautionary tales illustrate how informed choices can either substantially increase or erode a person's financial standing. Historic market trends provide invaluable insights into potential returns and the associated risks, informing financial decisions.

In conclusion, investments are a critical determinant of Lisa Hogan's net worth. Strategic investment decisions can significantly enhance her financial standing, while less informed decisions can erode it. The potential rewards and inherent risks involved with various investment vehicles underscore the importance of a carefully considered and clearly defined investment strategy. Understanding the correlation between investments and net worth is fundamental to sound financial management, facilitating informed decisions that align with personal financial goals and objectives, thereby maximizing the chances of a favorable outcome. The benefits of a diversified portfolio, the impact of market trends, and the significance of assessing risk are all vital.

Real estate holdings significantly shape Lisa Hogan's net worth. The value of properties owned, whether residential or commercial, directly influences her overall financial picture. The appreciation or depreciation of property values directly correlates with fluctuations in her net worth. Advantageous market conditions, characterized by increased demand and rising property values, generally lead to an increase in an individual's net worth. Conversely, decreasing property values can reduce overall net worth.

Ownership of prime real estate, such as properties in sought-after locations or historical buildings, represents a significant component of net worth. Real estate transactions, including acquisitions, sales, and rental income, exert a direct influence. A successful property sale at a premium above market value, for example, would substantially increase net worth. However, selling at a loss or the inability to secure desirable rental income can negatively impact the net worth calculation. The strategic management and potential appreciation of real estate investments are critical to maintaining and increasing net worth.

Real estate is an influential element in determining Lisa Hogan's net worth. The value of real estate holdings, prevailing market conditions, and the strategic management of these assets are all key factors. Fluctuations in real estate values directly affect the net worth calculation, illustrating the intrinsic connection between property ownership and overall financial standing. Recognizing the interplay between real estate and net worth is essential for assessing financial well-being, both for individuals and broader economic analyses. This understanding also provides insights into asset allocation strategies and long-term financial planning.

Expenses directly affect Lisa Hogan's net worth. A close examination of expenditures is crucial to understanding her overall financial standing. High expenses relative to income can reduce her net worth, while disciplined spending allows for greater accumulation of assets, thus increasing her net worth. This relationship is fundamental to assessing her financial health and stability.

- Lifestyle Expenses

Daily living costs, including housing, food, transportation, and entertainment, exert considerable influence on her net worth. High lifestyle expenses can erode accumulated wealth more quickly than a lower expenditure rate. If expenses exceed income, this disparity directly reduces net worth. Conversely, efficiently managing lifestyle expenses allows for greater savings, promoting asset accumulation and a higher net worth.

- Debt Repayments

Debt obligations, such as loan payments and credit card interest, represent ongoing expenses. High levels of debt can consume significant resources. Efficient debt management, including strategically paying down high-interest debts, reduces the strain on income and releases capital, potentially increasing net worth.

- Investment Expenses

Expenses associated with investments, such as brokerage fees, management fees, and taxes on investment income, are crucial considerations. A complete understanding of these expenses is vital for assessing the true return on investments. Minimizing unnecessary expenses tied to investments improves the net return and contributes to increasing net worth.

- Tax Obligations

Tax payments, which vary based on income and deductions, represent a substantial expense. Taxes directly reduce disposable income. Calculating and planning for tax obligations is essential for minimizing the impact on resources available to build and maintain assets. Smart tax planning can free up funds to build assets and increase net worth.

In conclusion, expenses are an integral part of the net worth calculation. Efficient management of lifestyle expenses, debt obligations, investment expenses, and tax obligations is critical. Careful planning and control of these elements enable greater wealth accumulation, thus contributing to a higher net worth. Understanding these factors is essential for evaluating and managing financial health.

Public information contributes to estimating Lisa Hogan's net worth, but a precise figure remains difficult to pinpoint. Openly available data, when correctly analyzed, can provide valuable insights into the potential size and composition of her assets and financial standing. However, such information is often incomplete and requires careful interpretation.

- Financial Reports and Public Records

Financial reports, if available, offer data about businesses or ventures Lisa Hogan might be involved in. Public records, such as property ownership documents, may disclose real estate holdings. A thorough analysis of these reports can suggest a rough estimate of her assets, though with inherent limitations. For instance, if public records indicate ownership of substantial real estate, this may suggest a higher net worth compared to someone with no such record. However, public records rarely detail the full extent of an individual's investments.

- Media Coverage and Public Statements

News articles, interviews, and public statements can occasionally offer clues about an individual's lifestyle or financial status. For instance, mention of luxury goods, travel, or charitable activities, if significant, might suggest a higher potential net worth. These insights are inherently subjective and not a definitive measure. Furthermore, they only reflect one aspect of the total picture. Even lavish spending habits do not conclusively signify a specific net worth.

- Industry Analysis and Comparables

Industry analysis can provide context by examining average income and asset values among individuals working in a similar field to Lisa Hogan. This data can offer a broad benchmark. Comparables, individuals with similar roles and experiences, can offer a general framework to estimate a potential net worth range. However, comparing Lisa Hogan to other individuals should not be treated as an exact science. Variances in career paths, individual choices, and opportunities can introduce significant differences.

- Limitations of Public Information

It's crucial to recognize the limitations of relying solely on public information. Access is often restricted, and data availability can vary significantly. Public information generally provides only a partial picture. Significant assets may not be disclosed publicly, and privately held investments remain hidden. External economic factors significantly influence net worth estimates based on publicly available data.

Public information, though valuable, only provides fragments of the overall picture of Lisa Hogan's financial standing. Careful assessment and interpretation of available data, combined with broader contextual information, contribute to a general estimate. A precise determination of net worth would require access to detailed financial records, which are rarely accessible to the public.

Estimating net worth, including Lisa Hogan's, relies on employing various valuation methods. These offer approaches to quantify assets, considering their market value, intrinsic worth, and potential future returns. Accurate valuation is crucial to comprehending an individual's financial standing, and the chosen approach can considerably influence the estimated net worth.

- Market Comparison Approach

This approach compares Lisa Hogan's assets to similar assets in the current market. For example, evaluating real estate holdings involves comparing recent sales of comparable properties in the same area. Appraisals frequently rely on this approach, factoring in the location, size, and condition of the compared properties. This method provides a reasonable estimate of market value, influenced by current market conditions.

- Income Approach

Estimating net worth using the income approach considers the income generated by assets. For example, rental income from real estate or dividends from stocks provide a basis for valuation. Analyzing comparable income streams helps establish a reasonable expectation of future earnings, a key consideration for appreciating the overall value of assets. This approach is particularly useful for businesses or assets producing revenue.

- Cost Approach

This approach assesses the current cost to replicate or replace an asset. For instance, the cost of constructing a similar building influences the valuation of real estate. Adjustments for depreciation and obsolescence are essential to reach a realistic market value. The cost approach is commonly used for unique or specialized properties.

- Discounted Cash Flow (DCF) Analysis

For assets that generate future cash flows (such as businesses), DCF analysis is commonly used. This approach estimates the present value of future cash flows, considering factors such as expected growth rates and discount rates. It's a valuable method for valuing companies or investments with predictable future cash flow. However, the accuracy depends on the accuracy of the projections.

Applying these valuation methods to Lisa Hogan's assets, whether real estate, investments, or other holdings, requires meticulous data gathering and careful judgment. Employing multiple approaches and considering current market conditions allows for a more comprehensive understanding of her estimated net worth. These methods, while useful, provide only an estimate and do not guarantee absolute accuracy due to the inherent complexities in valuing assets.

This section addresses common inquiries regarding Lisa Hogan's financial standing. Information on net worth is complex and subject to change.

Question 1: What constitutes "net worth"?

Net worth represents an individual's financial position at a specific point. It's calculated by subtracting total liabilities (debts, obligations) from total assets (possessions of economic value).

Question 2: Why is precise information on Lisa Hogan's net worth difficult to obtain?

Publicly available financial information for individuals is frequently limited. Personal financial details are generally private, and complete transparency is not expected. Determining a precise net worth requires access to comprehensive financial records, which are not always publicly accessible.

Question 3: How is net worth approximated when exact data is unavailable?

Net worth approximations often employ methods, such as market comparisons, analyzing income streams, considering replacement costs, or projecting future cash flows.

Question 4: Can media depictions influence perceptions of Lisa Hogan's net worth?

Public perceptions can be influenced by media portrayals. Descriptions of lifestyle, property, or other visible indicators often shape public opinion but are not always definitive.

Question 5: How do changes in asset values affect net worth?

Changes in market value affect net worth calculations. Increased asset values usually lead to a higher net worth, while decreased values result in a lower net worth.

In understanding net worth, it's important to consider the complexities of personal finances, the limitations of public information, and the methods used for estimation.

While a precise figure remains elusive, exploring the factors influencing net worth emphasizes financial choices, market conditions, and individual circumstances.

- Pallavi Sharda The Untold Story Of The Actress Dancer Model

- Is Gary Anderson Really This Rich A Deep Dive Into Net Worth

Lisa Hogan (Jeremy Clarkson's Girlfriend) Age, Net Worth

Lisa Hogan Age Everything You Need To Know About Her

Lisa Hogan Wikipedia Age Jeremy Clarkson Wife Net Worth