Decoding: Lauren Sanchez's Ex-Husband Net Worth - The Facts!

Is it truly our business to know the financial details of those who briefly orbit the lives of the famous? The intense public curiosity surrounding a public figure's former spouse's finances is undeniable, raising fundamental questions about what information is considered fair game and just how accurately we can ascertain someone's economic reality. This article navigates the treacherous waters of publicly available information, exploring the multifaceted elements that contribute to the perceived, and often speculated, financial standing of individuals connected to high-profile personalities.

In dissecting the labyrinthine topic of personal finance, the term "net worth" serves as our central compass. Defined as the aggregate value of an individual's assets encompassing tangible possessions like real estate, liquid investments, and cold, hard cash minus their cumulative liabilities, such as outstanding debts and binding obligations, net worth ostensibly provides a snapshot of financial health. Information regarding a person's net worth, especially in the context of a public figure, can surface from diverse and often unreliable sources: diligently prepared financial statements, meticulously kept court records, and, of course, the ever-present media reports. However, the crucial caveat remains: none of these sources guarantee a complete or error-free depiction. Publicly accessible details may not accurately portray an individual's current financial circumstances and certainly should not be viewed as the definitive truth.

The significance of scrutinizing an individual's former spouse's net worth arises in various scenarios. In the contentious arena of legal proceedings divorce settlements, child support battles financial intelligence is frequently a game-changer. Insight into assets can be pivotal for all parties involved in determining just and equitable settlements. Moreover, in the theater of public life, such information can intrigue the media and the public, its relevance dictated by the magnitude of the personality involved and the nature of the situation. However, a crucial distinction must be made between the publicly available narratives and the genuine, and often private, realities of a person's financial status.

- Riley Mae Onlyfans The Secrets Behind Her Success Updated

- Will Estes The Untold Story Facts About His Career

| Category | Detail |

|---|---|

| Full Name | Patrick Whitesell |

| Date of Birth | February 5, 1965 |

| Place of Birth | Iowa Falls, Iowa, United States |

| Nationality | American |

| Education | Luther College, Decorah, Iowa |

| Occupation | Executive Chairman, Endeavor |

| Known For | Co-founding and leading William Morris Endeavor (WME), a global entertainment agency. |

| Previous Spouse | Lauren Snchez (m. 2005; div. 2019) |

| Children | 2 |

| Website | Endeavor |

To truly grasp the complexities of any specific case, further investigation becomes paramount. This involves a meticulous dissection of readily available information, scrutiny of the individuals involved, and rigorous source verification. Delving deeper might entail scrutinizing court documents, poring over financial disclosures, or examining official records. It's a process of piecing together a puzzle, each document and data point acting as a fragment that, when viewed holistically, hopefully forms a more coherent picture.

The act of pinning down a definitive financial status for anyone, but particularly a former spouse with ties to public figures, demands a thoughtful approach and an appreciation for nuance. Information surrounding such matters is rarely straightforward, and often, the full story remains shrouded in ambiguity. The challenge lies in sifting through the available details, recognizing the inherent limitations, and drawing informed conclusions based on a careful analysis of what is, and is not, known.

- Public Records

- Financial Disclosure

- Asset Valuation

- Legal Proceedings

- Media Reports

- Privacy Concerns

Public records, including court filings and official financial disclosures, offer glimpses into an individual's economic standing, yet these are just pieces of a larger puzzle. Asset valuation, especially with complex investment portfolios, introduces another layer of intricacy. Legal battles and media coverage can shed light on certain financial aspects, but privacy concerns and the fundamental constraints of publicly available data mean a complete and unequivocal determination remains elusive. For example, granular financial statements, particularly those concerning private investments, are rarely open to public consumption. What's more, published accounts may be incomplete, lacking crucial details, or strategically omitting information.

- Unveiling Mikayla Demaiter Relationships From Past To Present

- Boost Your Feed What Is Unsee Link Amp How To Use It

Public records are cornerstones in building our understanding of financial landscapes, even those belonging to individuals tangentially connected to fame, such as Lauren Sanchez's ex-husband. These records, frequently accessible through legal channels or official filings, afford us a window into potential holdings and debts, theoretically illuminating their financial situation. However, interpreting these records demands rigorous consideration of their inherent limitations and the potential for hidden complexities.

- Court Documents:

Court documents, especially in the emotionally charged environment of divorce proceedings, frequently mandate financial disclosures. These filings can meticulously detail property ownership, investment portfolios, and income streams. Examples might encompass real estate holdings, retirement accounts brimming with years of savings, or ownership stakes in lucrative business ventures. While the implications for gauging a person's net worth are considerable, these disclosures often operate under legal constraints, may lack comprehensive detail, and, critically, might not reflect the complete financial picture. They offer a snapshot, not a complete film.

- Financial Statements:

Publicly accessible financial statements, when they exist, can provide invaluable insights into a person's financial activity. These statements can reveal details about income, expenditures, and asset accumulation. However, the availability and comprehensiveness of these statements fluctuate wildly. Even when available, complete transparency is hardly guaranteed; data may be aggregated, summarized, or strategically presented to obscure a full understanding of net worth.

- Property Records:

Property records offer a tantalizing glimpse into real estate ownership, detailing properties owned by an individual and potentially shedding light on their asset holdings. However, when property is held jointly or within intricate ownership structures, determining the precise share and value attributable to an individual can prove incredibly challenging. As such, property records alone rarely provide a complete understanding of someone's overall net worth.

- Tax Records (Limited Availability):

Tax records, while undeniably relevant, are rarely, if ever, readily available to the public. Stringent access restrictions and legitimate privacy concerns limit public scrutiny of an individual's tax information. Even if accessible, interpreting tax filings to accurately ascertain net worth can be fiendishly complex, hinging on specific circumstances and the nature of the taxes levied.

Therefore, while public records offer potential clues into the financial history of someone like Lauren Sanchez's ex-husband, they must be approached with extreme caution. Information gleaned from these sources demands careful evaluation, acknowledging the data's inherent complexities, limitations in accessibility, and the potential for inaccuracies or outright omissions within publicly available documents. Interpreting these documents independently, without the guidance of seasoned legal or financial experts, is strongly discouraged. A firm understanding of the context and the inherent limitations of these records is absolutely vital.

Financial disclosure, especially within the context of legal proceedings like divorce, plays a pivotal role in defining an individual's financial standing. When public figures like Lauren Sanchez's ex-husband are involved, public interest in these financial details intensifies exponentially. This exploration will dissect the role of financial disclosure in elucidating an individual's economic circumstances. The availability and character of these disclosures exert a direct influence on the public's grasp of the financial facets at play.

- Disclosure Requirements:

Legal dictates surrounding financial disclosure vary significantly based on jurisdiction and the specific nature of the legal proceeding. These mandates often dictate the precise types of information that must be disclosed, including assets, liabilities, income streams, and expenditures. Variations in these requirements across different legal landscapes can lead to gaping disparities in the comprehensiveness and detail of the disclosed information. In certain situations, full transparency may be curtailed by legal safeguards or overriding privacy concerns, thereby impacting the information accessible to the public.

- Types of Assets and Liabilities:

The nature of the disclosed assets and liabilities is of paramount importance. This encompasses everything from real estate holdings and investment portfolios to business interests and any outstanding debts or loans. The specific details contained within these disclosures can paint a vivid picture of financial holdings, income levels, and potential financial obligations. The quality and specificity of the disclosures profoundly influence the clarity and completeness of the resulting financial profile.

- Limitations of Disclosure:

Financial disclosure is not without its inherent limitations. The breadth and depth of disclosed information depend heavily on the specific legal context, potential restrictions on disclosure imposed by law, and the possibility of strategic withholding of specific details. This lack of complete transparency can compromise the accuracy and reliability of the financial intelligence available in such cases. For example, the complex web of investment portfolios or the labyrinthine structure of business entities can obscure a clear picture of financial standing.

- Public Perception and Impact:

Public perception wields significant power when an individual's financial details become public fodder. Disclosure can sway public opinion, potentially jeopardizing career prospects or impacting professional relationships, particularly for those already in the public eye. The transparency, or lack thereof, in financial disclosures, therefore, carries both practical and far-reaching social consequences.

In conclusion, financial disclosure, while potentially revealing, is frequently constrained by inherent limitations. Public understanding must account for these limitations and the surrounding contextual factors when attempting to interpret financial details. The accuracy and comprehensiveness of these disclosures directly influence the ability to fairly assess financial standing, a critical element in understanding the narrative surrounding Lauren Sanchez's ex-husband's net worth.

Accurate asset valuation lies at the heart of determining net worth, especially when dealing with public figures like Lauren Sanchez's ex-husband. A precise assessment of assets is crucial in financial settlements, informing legal proceedings, and shaping public perception. The inherent complexity of asset valuation necessitates careful consideration of a multitude of factors.

- Market Fluctuations and Appraisal Methods

Market forces exert a powerful influence on asset values. Real estate values, stock prices, and the worth of other investments rise and fall in accordance with prevailing market trends. Rigorous appraisal methods, like professional real estate valuations conducted by certified appraisers or independent stock assessments performed by financial analysts, are necessary to reflect current market realities. In situations where assets are complex or involve private investments not readily traded on public exchanges, securing reliable and up-to-date valuations is paramount and may necessitate the involvement of specialized expertise. This is particularly critical when evaluating an intricate financial portfolio, where inconsistencies and discrepancies in valuation can easily arise.

- Complex Holdings and Business Interests

Complex holdings, encompassing privately held businesses or elaborate investment portfolios, demand highly specialized valuation methods. Appraising these asset types necessitates a thorough assessment of underlying factors, such as projected earnings potential, market share, and future growth forecasts. Detailed financial analysis and, potentially, expert opinions from seasoned industry professionals are often indispensable. The valuation process can be fraught with complexities and potential disputes if the assets are not publicly traded, making demonstrably accurate valuation a significant challenge.

- Joint Ownership and Legal Considerations

When assets are held jointly, the proportion of ownership and the valuation strategies employed become legally relevant and often intricately complex. Precisely determining individual ownership percentages within jointly held properties or investments is crucial for accurate asset allocation. Legal precedents, binding agreements, and partnership structures exert a vital influence in these circumstances. Potential disputes, looming legal challenges, and the need for skilled legal counsel can further complicate the asset valuation process in cases involving joint ownership.

- Potential for Bias and Discrepancies

Valuation processes are inherently susceptible to bias, particularly when relying on a single report or appraisal. The risk of discrepancies escalates across different valuation methodologies, potentially leading to disputes and challenges to the accuracy of the final assessment. Independent verification from multiple sources can mitigate the impact of bias and enhance the accuracy of the overall valuation. Comparisons to similar assets and established market benchmarks can also help identify potential inconsistencies and biases embedded within valuation assessments.

Accurate asset valuation is far from a simple task; it's a multifaceted undertaking demanding specialized skills, an acute awareness of market dynamics, sound legal considerations, and unwavering scrutiny. The inherent complexities involved in assessing assets, especially in situations involving publicly perceived high net worth, underscore the critical importance of engaging professional valuations and practicing thorough due diligence. These factors are essential for establishing a precise understanding of an individual's true financial status, especially in the context of unraveling the narrative surrounding Lauren Sanchez's ex-husband's net worth.

Legal proceedings wield significant influence in determining an individual's financial standing, particularly concerning a public figure's former spouse like Lauren Sanchez's ex-husband. Divorce cases, for example, frequently require meticulous financial disclosures. These proceedings establish a formal mechanism for evaluating assets, liabilities, and income, offering a crucial component in understanding overall net worth. The legal framework dictates the types of information mandated, the acceptable methods for valuation, and the final resolution of all financial matters.

Court-ordered valuations of assets, particularly those with complex holdings or intricate financial structures, are paramount in such proceedings. Legal precedents and previous rulings establish guidelines and benchmarks for asset division, including meticulously determining the value of real property, diverse investment portfolios, and controlling business interests. Financial disclosures mandated in these cases often require detailed documentation of income sources, itemized expenses, and all outstanding debts. These disclosures serve as the bedrock for subsequent legal decisions pertaining to asset division, alimony payments, or child support obligations, demonstrating the profound impact of legal proceedings on defining financial standing. Examples abound of cases where assets are held jointly, necessitating exhaustive legal analysis and definitive rulings to ensure a fair and equitable division. Court-appointed experts are frequently enlisted to independently assess complex assets, offering objective valuations that are critical for impartial decision-making.

Comprehending the role of legal proceedings is essential for properly evaluating the concept of "net worth" in these sensitive circumstances. The entirety of the legal process, from initial financial disclosures to final judgments, directly shapes the understanding and determination of financial standing. These proceedings establish concrete financial realities, often influencing public perception of a public figure's former spouse's economic circumstances. However, the inherent complexities of legal frameworks, the potential for protracted disputes, and the limitations of publicly available information demand a cautious approach when interpreting any single legal outcome. Further investigation, potentially including an exhaustive analysis of specific court documents, is often necessary to fully grasp the intricate connections between legal proceedings and the ultimate assessment of net worth in such cases.

Media reports, within the specific context of a public figure's ex-spouse, such as Lauren Sanchez's ex-husband, often serve as a primary conduit for disseminating information related to their financial circumstances. These reports can vary significantly in both accuracy and completeness, but they frequently play a pivotal role in shaping public perception of the subject's financial standing. The insatiable public interest in such matters can lead to extensive reporting, highlighting the complex interplay between public figures, their intensely scrutinized personal lives, and readily digestible financial information.

- Reporting of Public Disclosures:

Media outlets frequently report on publicly available financial disclosures, such as those included in legal filings stemming from divorce proceedings or other legal battles. These reports often summarize key details extracted from court documents, emphasizing significant assets, outstanding debts, or substantial income streams. Examples might encompass reporting on sprawling real estate holdings, diverse investment portfolios, or controlling business interests specifically mentioned in official records. The ultimate accuracy of these reports rests squarely on the accuracy of the source material, and careful scrutiny of the media's presentation of these disclosures is crucial for understanding their inherent limitations.

- Speculation and Analysis:

Beyond simply reporting factual information gleaned from official sources, media reports frequently engage in speculation and analysis regarding an individual's estimated net worth. These analyses often draw conclusions based on reported incomes, assessed asset valuations, or comparisons to similarly situated figures. Examples might include articles attempting to estimate a net worth based solely on publicly available information. It is essential to maintain a clear distinction between reported facts and speculative assessments when evaluating such information. The credibility of these analyses often hinges on the expertise of the analysts involved and the rigor of the methodologies employed.

- Potential for Bias and Misrepresentation:

Media reports, like any form of communication, are inherently susceptible to bias and the potential for misrepresentation. News sources may selectively focus on aspects that align with particular narratives, leading to a skewed presentation of an individual's financial circumstances. Examples might include the selective reporting of positive developments while downplaying negative indicators, or a focus on sensationalizing negative aspects to capture audience attention. Evaluating news reports critically, carefully considering the reliability of the source, and actively seeking out multiple perspectives are crucial steps in mitigating this pervasive challenge.

- Influence on Public Perception:

Media portrayals of financial details can exert a profound influence on public perception of individuals. The specific details presented, even if not definitively accurate, can significantly shape public opinion regarding an individual's financial standing. Examples include observing how public perception might fluctuate wildly if a negative portrayal of financial status is widely disseminated. It is essential to carefully consider the potential influence of these reports on public opinion and their potential impact on the individuals involved.

In conclusion, media reports on financial matters, such as those pertaining to Lauren Sanchez's ex-husband's net worth, offer a complex and often contradictory mix of reported facts, speculative assessments, and potential biases. Carefully considering the reporting methods employed, meticulously verifying the credibility of the source, and critically assessing the potential impact on public perception are all necessary when evaluating information presented within this context. Evaluating media reports with a discerning eye, acknowledging the potential for bias, and actively seeking out multiple perspectives are vital for forming a balanced and well-informed understanding of such complex matters.

The relentless public interest in the financial status of a public figure's ex-spouse, such as Lauren Sanchez's ex-husband, frequently clashes head-on with fundamental privacy concerns. The unchecked dissemination of financial information, even when legally sourced from public records, can raise deeply troubling ethical and practical questions regarding an individual's right to privacy and financial autonomy. This section will examine the complex interplay between public interest and individual privacy within this sensitive context.

- Confidentiality of Private Financial Information

The dissemination of detailed financial information, even when deemed legally accessible, can represent a significant breach of an individual's right to privacy. Such information often encompasses sensitive details concerning personal finances, investment strategies, and legally binding financial obligations. The public revelation of this information can expose individuals to unwarranted scrutiny, potentially disrupting their personal and professional lives in profound ways. This is particularly concerning in situations where financial data may be easily misconstrued or intentionally used for illegitimate purposes. Examples might include a public figure's ex-spouse facing reputational damage resulting from inaccurate or incomplete media reports.

- Potential for Misuse and Misinterpretation

Publicly available financial information, even when responsibly sourced from legitimate sources such as court records, remains inherently susceptible to misinterpretation and outright misuse. Without providing the proper context and offering appropriate qualifications, isolated details can be easily extracted from context, leading to inaccurate and ultimately unfair portrayals of a person's overall financial standing. This can quickly result in unwarranted stigmatization or negative publicity, even when the initial information is presented in an ostensibly objective and impartial manner. Examples include sensationalized speculation and broad generalizations drawn from limited or incomplete information.

- Impact on Reputation and Relationships

The public revelation of private financial information can exert a devastating impact on an individual's reputation and their personal and professional relationships. This is particularly true for public figures, whose personal lives are, to some degree, already a matter of public record. The disclosure of sensitive financial details, particularly in the emotionally charged context of divorce proceedings, can be incredibly taxing and potentially damaging to personal and professional connections, impacting relationships with family members, close friends, and future business partners. Examples include negative press reports affecting an individual's ability to secure future employment opportunities or attract new business ventures.

- Balancing Public Interest and Privacy Rights

The ongoing debate over public interest versus individual privacy rights regarding the disclosure of financial information requires a careful and nuanced balancing act. While the public may have a legitimate interest in understanding the financial affairs of prominent figures, these interests must be carefully weighed against the individual's fundamental right to privacy and the potential for causing significant harm. Examples include thoroughly considering the potential for real-world harm versus the purported benefit of making sensitive financial information publicly accessible. Striking this delicate balance often requires careful legal considerations and responsible journalistic practices in the dissemination of potentially damaging information.

In the specific context of Lauren Sanchez's ex-husband's net worth, legitimate privacy concerns necessitate a thoughtful and nuanced approach to both reporting and public discourse. While certain aspects of financial information may be publicly accessible through legal channels, the potential harm to an individual's well-being and privacy must be given serious and sustained consideration. Responsible media reporting practices and a mindful approach to disseminating sensitive financial information are crucial for mitigating potential harm and upholding fundamental ethical standards. A holistic understanding of the multifaceted implications, from existing legal frameworks to potential societal impact, is critical for navigating this complex and often ethically fraught issue.

This section addresses the most frequently asked questions surrounding the financial status of Lauren Sanchez's former spouse, Patrick Whitesell. Obtaining accurate information about net worth is inherently complex and deeply dependent on a range of specific factors. This FAQ section provides clear and concise answers based on the best publicly available information, while carefully considering all relevant limitations and caveats.

Question 1: How is net worth typically calculated for individuals in situations like this?

Net worth is typically calculated by subtracting an individual's total liabilities (including outstanding debts and financial obligations) from their total assets (encompassing all possessions with tangible monetary value). Specific factors taken into account include real estate holdings, diverse investment portfolios, and controlling interests in business ventures. This calculation is inherently complex and may not fully reflect a person's true current financial position. Publicly available information often represents a mere snapshot in time and may lack crucial details or be deliberately misleading.

Question 2: Where can one typically find reliable information regarding net worth in cases like this?

Information pertaining to net worth, particularly in cases involving public figures and their former spouses, can potentially come from a diverse range of sources, each with its own limitations. Court documents, particularly those directly related to legal proceedings such as divorce settlements, can potentially contain valuable financial disclosures. Public records, like official property assessments or mandatory business filings, might also provide some insights into an individual's overall financial picture. However, it is important to recognize that full transparency is rarely guaranteed, and the data available may only present a partially complete financial picture. Media reports may also offer summarized versions of this data, but these frequently involve subjective analysis and interpretation rather than definitive and verifiable figures.

Question 3: What is the significance of knowing an individual's net worth in cases like this?

Understanding an individual's net worth can be significant in various contexts. In sensitive legal proceedings, such as complex divorce cases, accurate financial information is often critical for ensuring fair and equitable settlements. In the arena of public affairs, this information, when responsibly gathered and verified, might provide valuable context for public discussion and policy debates. However, it is crucial to scrupulously avoid drawing hasty conclusions based on potentially incomplete or intentionally misrepresented data.

Question 4: How might privacy concerns affect the availability and accuracy of this type of information?

Legitimate privacy concerns often significantly limit public access to detailed and sensitive financial information. Legal restrictions, legally binding confidentiality agreements, and the inherent desire to protect private financial details may actively prevent complete transparency. Publicly accessible information, therefore, may not accurately reflect a comprehensive financial picture. It's absolutely essential to recognize these potential limitations when working with this type of data and to avoid drawing definitive conclusions based on incomplete information.

Question 5: How accurate is the information regarding a person's net worth when it is found in various media reports?

Media reports frequently summarize or interpret publicly available data. The accuracy of this information can vary significantly, depending on the reliability of the sourcing and the rigor of the analytical methods used. It is generally prudent to treat such information as a potential starting point for further research, rather than accepting it as a definitive statement of an individual's true financial standing.

In summary, accurately determining a person's true net worth, particularly for public figures and their former spouses, often involves navigating a complex landscape of various sources, each with its own inherent limitations and potential uncertainties. Making accurate estimations requires carefully considering the origin of the information and the context in which it was obtained. Extreme caution is generally warranted when drawing firm conclusions based on incomplete or potentially biased reporting.

This concludes the FAQ section. The following sections will delve deeper into the intricate and often challenging aspects of determining and interpreting financial information in cases like these.

This detailed exploration of Lauren Sanchez's ex-husband, Patrick Whitesell's financial standing underscores the immense complexities inherent in accurately evaluating an individual's net worth, especially when dealing with high-profile public figures. Publicly accessible information, while potentially offering some initial insights, is often limited in scope and subject to varied interpretations. Court records, mandatory financial disclosures, and even media reports may provide glimpses into a person's past financial history, but these sources frequently fall short of providing a truly comprehensive and definitive financial picture. Accurate asset valuation, particularly for complex holdings or privately held business interests, requires specialized financial knowledge and extensive expertise, and even then, precise figures often remain elusive in many instances. Furthermore, legitimate privacy concerns and potential biases within media reporting further highlight the significant challenges in obtaining a truly objective assessment of someone's financial standing.

Ultimately, the quest for obtaining a precise figure for Patrick Whitesell's net worth remains stubbornly elusive, heavily reliant as it is on inherently imperfect and subjectively interpreted publicly available data. The countless nuances of asset valuation, the potential pitfalls of legal proceedings, and the inherent biases of media reporting all illustrate the significant challenges of accurately obtaining a clear and unbiased financial picture. Any conclusions drawn from the available information should be treated as tentative and heavily context-dependent. Furthermore, a sincere respect for privacy and an ethical consideration of presenting potentially sensitive information objectively are of paramount importance when addressing such delicate topics. A balanced and nuanced approach, one that openly acknowledges the limitations and potential biases present in readily accessible data, is absolutely critical when engaging with subjects as complex as the net worth of a public figure's former spouse.

- Lil Jeff The Untold Story Of Rising Star Rapper 2024 Update

- Zefoycom The Ultimate Guide To Web Hosting More 2024

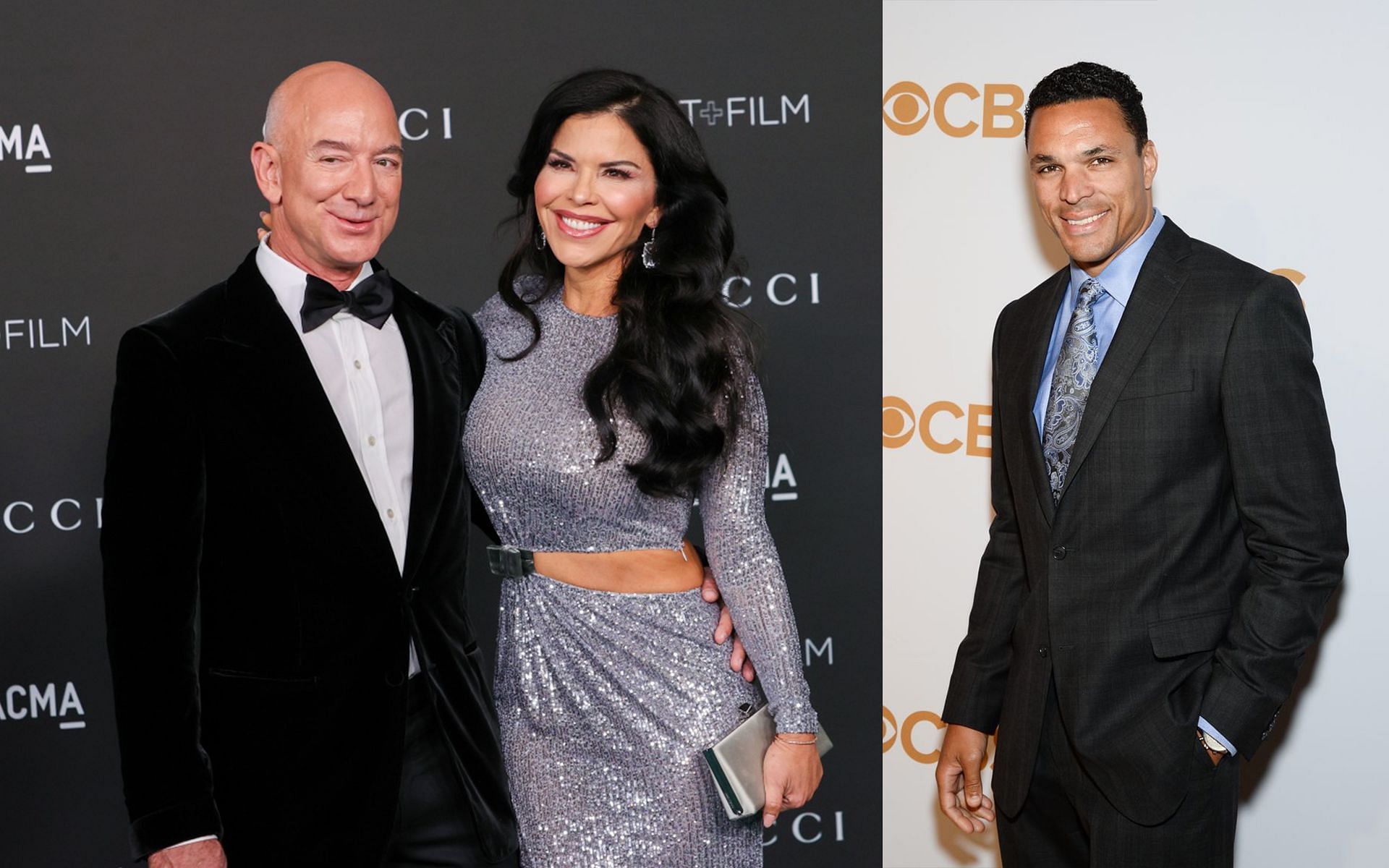

Who is Lauren Sanchez' exhusband? Former NFL star parties with Jeff

How did Bezos' GF Lauren Sanchez look before plastic surgery

Who is Tony Gonzalez exhusband of Lauren Sanchez, net worth, bio, age